LEVY FOR LIFE

ON OUR PENSIONS

THE GOVERNMENT’S LEGACY

____________________________________

Click Here for Link to Radio Kerry Interview with ESBRSA Chairman Tony Collins re 7.7% Pension Raise Claim

Spring Update 14th. March, 2024

ESB RETIRED STAFF ASSOCIATION ESTABLISHED 1974

NATIONAL EXECUTIVE COMMITTEE

T. COLLINS J. DEVLIN A. McCAFFERTY TOM ‘OBRIEN

CHAIR SECRETARY TREASURER VICE-CHAIR

Mr. Terence O’Rourke,

ESB Board Chairman,

27 Lower Fitzwilliam Street,

Dublin 2.

7th January 2025

Copy to: Mr. Paddy Hayes, ESB Chief Executive

Mr. James O’Loughlin, Pensions and Insurance Manager

As National Chairman of the ESB Retired Staff Association, I question the integrity of past decisions by ESB Senior Management and the Board. The issues raised are factual and not speculative. The injustices faced by ESB pensioners result from actions approved by the ESB Boards over many years.

Background

The reasons why I address this letter directly to you as ESB Board members are :

(1) The ESB Board members share collective responsibility for the decisions and actions undertaken by the ESB Executive Management. Ultimately, the responsibility for ESB affairs lies with the ESB Board members.

(2) The ESB Group Board is responsible for presenting the Annual Report & Accounts. Since 2010, statements in these reports about the ESB Defined Benefit Pension Scheme have conflicted with its governing legislation. The ESB Board appoints the Pension Scheme Actuary and approves all members of the Pension Scheme Board of Trustees.

(3) ESB has not yet implemented the statutory legislation included in the original 1942 Superannuation Act, as amended by the Energy (Miscellaneous Provisions) Act 1995, which is intended to support Government guarantees related to the ESB Pension Scheme as part of an Industrial Relations Agreement (CCR). Additionally, the rules of the ESB Defined Benefit Pension Scheme have not been aligned with the aforementioned statutory legislation.

(4) The 2010 Pensions Agreement, an Industrial Relations Agreement, was approved by ESB’s Board in October 2010. However, only 40% of the serving staff voted on its terms. While such agreements should involve all affected parties, ESB pensioners were included without their consent or consultation and have been financially disadvantaged as a result.

In summary, the ESB Board holds ultimate decision-making power for ESB matters. As former US President Harry Truman said, “The Buck Stops Here,” which applies to the ESB Board. The ESBRSA urges that all issues in this letter be seriously considered and discussed at an upcoming Board meeting, rather than being delegated to ESB Executive Management as done previously.

ESBRSA are giving ESB Board the opportunity to respond to all matters raised in this letter before they are pursued with the Irish & European Parliaments.

The 2010 Pensions Agreement and the inclusion of ESB pensioners without consultation have been discussed by the Department of Enterprise, Trade, and Employment Joint Oireachtas Committee. They are aware of the injustices faced by ESB pensioners, particularly in relation to The Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill 2021.

ESB Pension Scheme

Employees of the Electricity Supply Board (ESB) who were first employed before April 1995 were denied the opportunity by the State, in conjunction with ESB Management, to contribute towards the state contributory pension. As a result, all pre-1995 ESB employees do

not receive the state contributory pension nor the additional pension benefits associated with it.

The ESB Retired Staff Association (ESBRSA) asserts that ESB, rather than the pension scheme, are responsible for first-tier pension provision due to the exclusion of members from ‘full membership of social welfare’ up to the full state pension level. The ESBRSA also believes that this policy has been in place at ESB’s request since 1943. ESB has applied to the Government for, and lobbied to maintain, this position and has benefited significantly as a

result. This issue was central to the industrial relations dispute between ESB and the ESB Group of Unions in 2013, and ESBRSA considers this provision legally binding.

Since 2014, the state contributory pension has increased by 25% up to January 2025, equating to €57 per week or €2,964 per annum. ESBRSA believes that ESB should assume responsibility for paying this increase in the State Pension element directly to ESB pensioners. Therefore, ESBRSA formally requests that ESB take immediate steps to compensate ESB pensioners for the loss of this income.

The final salary pension scheme, initiated in 1942/43, was modelled on the Irish Government’s public service scheme, with the stipulation that it be a funded scheme. In 1971, the Government directed ESB to pay pension increases indexed to pay increases, similar to the public service scheme.

In 2010, the abolition of pay parity indexation without reference to or agreement with pensioners resulted in significant financial loss. Not only have pensioners lost pay parity, but they also do not benefit from the 25% increases in the State Contributory Pension element of their pensions that have been applied over the past ten years.

ESB’s Statutory Responsibilities’

This was one of the issues central to the IR dispute between ESB and the ESB Group of Unions in 2013, along with ESB’s statutory obligation to the DB pension scheme members and ESB’s responsibility, as the sponsoring employer, to ensure that the defined benefit pension scheme is adequately funded to provide future pension benefits for all members according to their entitlements, including pay parity with serving staff. Many of

these issues were outlined in a letter addressed to ESB Board members by the ESB Group of Unions at the time of the dispute.

This issue predates the 2010 Agreement by 15 years when the Government enacted the Energy (Miscellaneous Provisions) Act 1995 in order to underpin guarantees in relation to the Pension Scheme as part of an Industrial Agreement (CCR) finalized in1996.

Section 20 of the Energy (Miscellaneous Provisions) Act, 1995 which provided for the amendment of Section 7 (1) (b) of the primary legislation (the Electricity Supply Board (Superannuation) Act, 1942) as follows and I quote the relevant section of the Act

- (b) provide (save as otherwise provided by this section) that every person entitled to superannuation benefits under the scheme shall pay contributions to the said fund and that the Board shall from time to time make to the said fund such payments as are determined by the actuary to the scheme, AND

- (b) in such other manner as the trustees think proper; This wording allows the Scheme Actuary to determine the funding level required from the Sponsoring Employer during financial pressures or deficits. This makes the ESB Pension Scheme a “Balance of Cost” scheme, where the employer must cover any contribution shortfall.

ESB omitted this legislation from the Pension Scheme rules, allowing them to deny any obligation under it. Consequently, all Annual Reports since 2010 have consistently stated this omission.

“ESB has no legal obligation to increase contributions to maintain those benefits in the event of a deficit”

Funding of ESB Pension Scheme

Members who attended the ESB Pension Scheme Trustee event on 8th October 2024, or reviewed the 2023 Actuarial Valuation report, are aware of the challenges Trustees face in managing Fund investments to meet projected benefits.

Although the Scheme is currently 101% funded, narrow margins and declining contributions, along with its reliance on investment returns, pose financial risks. This underscores the importance of ESB’s commitment as Sponsoring Employer to ensure the Scheme’s future

solvency.

ESBRSA believes it is the responsibility of the ESB DB Pension Scheme Trustees, appointed by the ESB Board, to address these issues for members. ESBRSA has written to the Trustees and awaits a response.

Despite past concerns about ESB’s credit rating in 2010, improved ratings today eliminate justification for the unfair 2010 Agreement. ESB Group, now highly profitable with €868 million after-tax profits in 2023, operates in a different financial environment.

Conclusion and Actions Required

- ESBRSA finds it unacceptable and shameful that ESB failed to amend the Pension Scheme Rules according to the Industrial Relations Agreement, Cost and Competitiveness Review (CCR 1996), despite statutory legislation. This negligence requires immediate amendment of the Scheme Rules in line with the Primary 1942 legislation.

- To honor the 1996 tripartite CCR agreement, the Government enacted the Energy (Miscellaneous Provisions) Act 1995 to secure pension scheme guarantees and future funding. The CCR agreement also required staff to increase their pension contributions by 2% and ESB by 4%, based on an ESB Internal Industrial Council recommendation. This legislation and additional contributions must be fully acknowledged and implemented by the ESB Board to ensure future scheme funding and pensioner pay parity.

- ESBRSA finds ESB’s denial of its statutory responsibilities, outlined in the Electricity Supply Board (Superannuation) Act, 1942, unacceptable. The omission of the 1995 amendments from the Pension Scheme rules for nearly 30 years must be fully assessed. Additionally, it is important to question if the 2010 Pensions Agreement was necessary.

- The €1.9 billion deficit in the 2008 actuarial valuation was primarily caused by poor pension fund management and an overreliance on equities (over 70%). Traditionally, this issue could have been resolved through negotiation and referral to the ESB Industrial Council, which historically did not affect pensioners. After the financial crash, the Pension Fund recovered significantly within three years, reducing the

deficit and diversifying investments beyond equities. - ESBRSA views the exclusion of ESB staff members from full social welfare membership and the resulting potential income loss as serious. ESB must compensate pensioners for this lost income, as detailed under ESB Pension Scheme. Initially, ESB pensioners received an Occupational Pension similar to the Public Service Pension Scheme, with terms including indexation and pay parity with existing staff. This has not been the case for the past 14 years. With pay parity restored for the public service, it is crucial to immediately reinstate pay parity indexation for ESB pension scheme members, following the employment conditions upheld for 40 years.

- ESB pensioners need a voice in their occupational pension scheme, and ESB must respect and restore their terms and conditions. As members of the Defined Benefit Occupational Pension Scheme, pensioners lack rights and consultation. Despite making up 20% of the membership, only employee members are represented by trade unions. ESB pensioners demand equal treatment with current staff, and immediate

action from the ESB Board to ensure fairness for all scheme members. - ESB pensioners seek natural justice: an end to their exclusion, recognition of their views by ESB, and collective access to state-run arbitration like that available to Trade Unions and employee scheme members.

ESBRSA plans to urgently address these issues with the incoming Government and will persist until a satisfactory resolution is achieved. They will also bring this matter to the EU Parliament as a discrimination and equality issue, advocating for equal treatment of all ESB Pension Scheme members. Discussions are ongoing with several Irish MEPs to develop a strategy for resolving these issues. Adverse publicity for ESB is expected during ESBRSA’s pursuit of justice.

The ESB Retired Staff Association is committed to addressing concerns for all ESB pensioners regarding the mentioned matters, which have been raised in numerous correspondences since the 2010 Pensions Agreement. The Association now has renewed motivation from its members to address perceived issues of exclusion, discrimination, and

inequality. One significant concern is the impact of sustained high inflation on pensioners and the rising cost of living affecting all members of society, including ESB pensioners.

It is hoped that these issues will receive thorough consideration and discussion at the ESB Board level, and we look forward to a constructive response.

Sincerely yours

Tony Collins

Chairman, National Executive, ESB Retired Staff Association

Response from Geraldine Heavey

Executive Director, ESB Enterprise Services

January 20th. 2025

Dear Tony,

Your letter dated 7th January 2025 addressed to ESB Board Members and the Chief Executive has been passed to me for consideration and reply.

Your letter re-iterates a number of issues which have been raised before by the RSA in correspondence to ESB and at the Forum established by ESB.

As previously outlined both in correspondence and meetings of the Forum, ESB does not intend reopening the 2010 Pensions Agreement.

Yours sincerely,

Geraldine Heavey

Executive Director, ESB Enterprise Services

ESB RETIRED STAFF ASSOCIATION

ESTABLISHED 1974

NATIONAL EXECUTIVE COMMITTEE

T. COLLINS J. DEVLIN A. McCAFFERTY TOM ‘OBRIEN

CHAIR SECRETARY TREASURER VICE-CHAIR

To: Geraldine Heavy, Director Enterprise Services

Copies to: ESB Board of Directors

James O’Loughlin, Group Manager Pensions & Insurance

30 th. January 2025

Dear Geraldine,

I have received a response from you to a letter that I wrote to ESB Board members and Chief Executive and delegated to you.

Your response has been noted, and added to an already extensive correspondence file which contains the same or similar brief responses, no matter what issues were raised.

My letter was addressed to the Board Chairman and board members as they are responsible for ESB policies, and have a collective responsibility for decisions/actions taken or approved in ESB Group. I doubt if they even saw my letter. I would have expected the courtesy of a response from the Board of ESB.

ESBRSA have a record of numerous letters in the past, over many years, addressed to the Board of ESB and Chief Executive, all of which have been delegated for response, and without any of the issues raised being properly addressed. When we write letters with real substantive issues we do expect the courtesy of a response to those issues, Your recent letter was no different to previous responses.

My recent letter was not about the 2010 agreement as I’ve set out very clearly below, nor were any of the issues raised discussed at the Joint ESB & ESBRSA Forum. Unfortunately, the Forum, whose last meeting was more than 5 years ago, was a pointless exercise from an ESBRSA perspective, as it was used by ESB to have members of our Association educate ESB Managers on pension issues with no resulting benefit to pensioners.

This only adds insult to the injustices already experienced by ESB pensioners and also demeans the efforts of our representative Association in advocating for its members. It demonstrates a total lack of respect and a disregard for pensioners, revealing an ageist attitude on the part of ESB Management.

The main issues raised in my letter are human rights issues which you have failed to address:

- There is no support system in ESB for collective pensioner representation, which is

discriminatory, ageist and out of step with the right to equality of treatment - Pensioners rights are implied through their conditions of employment during their

working lives. This is based on the agreements around the ‘promise of income in the

future, and past commitments made by ESB. - The right to a voice and to be consulted over what happens to their occupational

pension scheme, with 80% of pension scheme members being pensioners or deferred

pensioners - The right for ESB to respect and restore pensioners terms and conditions, enjoyed for

a period of 40 years up to 2010 - The right to dignity and respect, along with equality of esteem with serving staff and

an assurance that all members of ESB Defined Pension Scheme are treated equally - The right to natural justice, meaning an end to the exclusion that pensioners are

currently subject to, with a recognition of their views and input by ESB.

Apart from the human rights issues contained in my letter, it referenced: - ESB’s denial of their statutory responsibility

- Future funding of ESB pension scheme

- The challenges faced by ESB pensioners due to the extremely high cost of living

None of these issues have been addressed.

ESBRSA intend to bring the above issues and more, to the attention of the relevant authorities in both the Irish and EU Parliaments, as discrimination, equality and human rights issues.

To get respect, one must earn that respect. ESBRSA have been more that tolerant in the past, with ample experience, over many years, of issues raised in correspondence and not addressed at all. The most recent case has been a step too far.

Your response to my letter of 7 th. January 2025 is disingenuous and disrespectful to ESB pensioners as is the complete disregard that ESB Senior Managers appear to hold for pensioners.

I again request that the very critical issues raised in our correspondence are given serious consideration & responded to appropriately.

Sincerely yours

Tony Collins

Chairman, National Executive, ESB Retired Staff Association

18th February 2025

Mr. Tony Collins

Chairman National Executive

ESB Retired Staff Association

Dear Tony,

I refer to your letter dated 30th January 2025 and I note the points made. Your more recent correspondences again raise issues and positions which, as you know ESB has previously communicated its disagreement with. In essence the matters raised relate to the current operation of the defined benefit pension scheme, which is underpinned by the scheme rules

and the 2010 pensions agreement. As previously advised, ESB has no intention of reopening this agreement. While this may not be sufficient to assuage your concerns, it remains the position of the company. As such, I am hopeful that this letter may serve to draw a line under these issues as I do not expect that ongoing correspondence between the company and the RSA will provide any further clarity.

Yours sincerely,

Geraldine Heavey

Executive Director, ESB Enterprise Services

ESB RETIRED STAFF ASSOCIATION

ESTABLISHED 1974

NATIONAL EXECUTIVE COMMITTEE

T. COLLINS J. DEVLIN A. McCAFFERTY TOM ‘OBRIEN

CHAIR SECRETARY TREASURER VICE-CHAIR

5 th. March 2025 Without Prejudice

Dear Geraldine,

I have received your response to my letter of 30 th. January 2025.

Once again, your brevity in communication is apparent, and you have incorrectly stated that all concerns raised have been addressed in prior correspondence. RSA has never raised ESB’s denial of basic human rights to pensioners before.

Your responses to correspondence and failure to address the concerns of pensioners, reveals your lack of experience in these matters and your lack of an historical perspective on ESB affairs. It seems that you have misunderstood the core message of the content.

Does your response represent the views of the ESB Board, the principal decision-making forum for the organization, to whom I initially wrote?

Your persistent adherence to the 2010 agreement and repeated statement that “the company has no intention of reopening the agreement” shows a misunderstanding of my letter’s issues.

The 2010 agreement had significant implications for pensioners, impacting their rights to equality of treatment, inclusion, respect, dignity, and participation in decisions regarding their occupational pensions. Some pensioners, particularly those now in their late 80s, did not fully

understand the nature or reasons behind their inclusion in the agreement post-retirement. The Industrial Relation Acts do not define a retired worker, raising questions about their legal standing in IR procedures. Therefore, including them in the 2010 agreement may have been a mis judgement by ESB.

The pursuit of “Human Rights” for pensioners is about real people, current and past ESB pensioners who dedicated over 40 years of service and contributed significantly to the ESB Group. Despite paying additional pension contributions during their careers to secure their future, they now face unmet expectations of financial security in retirement. The treatment of pensioners since the 2010 agreement has been poor, discriminatory, and out of step with the right to equality of treatment

“Human Resources” may have changed to “People & Sustainability, but where are the people

skills, where is the humanity? There is certainly none shown towards pensioners. The Chief Executive displayed his insensitivity towards customers in a recent interview, despite his retraction he caused embarrassment to ESB. Fortunately, the Networks crews have done

trojan work in restoring power to customers and as the face of ESB on the ground they may have saved some of the embarrassment for ESB Group.

Ageism and lack of humanity is pervasive and entrenched in our society, and unfortunately in ESB also, which is an observation commented on by our members at our national meetings.

The organization has lost its soul, is there still time for redemption? There appears to have been a significant shift in the attitudes of ESB Management since 2010, displaying less responsiveness and an insensitivity to the needs of others.

While the ESB Defined Benefit Pension Scheme is governed by the Scheme rules, discrepancies arise when these rules are not aligned with the primary legislation that oversees the Scheme. This misalignment prevents the Scheme from functioning as initially intended under the Industrial Relations Agreement (CCR) established in 1996, following the

enactment of the Energy (Miscellaneous Provisions) Act, 1995, which was part of the government’s contribution to this agreement. Joe Moran, who was the Chief Executive at the time, as well as his predecessors, would likely disapprove of the current prevailing attitude within ESB.

The 1995 amendment, part of the CCR IR agreement, established ESB’s responsibility to ensure future funding for the pension scheme.

Rest assured, none of the real concerns of ESB pensioners mentioned in my correspondence with the ESB Board & Chief Executive will be dismissed.

The next time these issues will be raised is in the context of ESBRSA’s pursuit of justice for ESB pensioners with both the Irish & EU Parliaments. All correspondence with ESB will be used to support the pursuit of justice for ESB pensioners.

Sincerely yours

Tony Collins

Chairman, National Executive,

ESB Retired Staff Association

Copies to: Group Manager Pensions & Insurance

Trustees of ESB Pension Scheme

Update 22nd. Oct, 2024

Up Coming General Election – A message from the NEC Chairman

To all ESBRSA members

As many of you will be aware, we in ESBRSA have been working with other Retired Staff Associations under the aegis of the Irish Senior Citizens Parliament (ISCP) to achieve the passing of The Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill 2021 with the objective of giving retired staff a voice and place at the table when our pension scheme is under discussion.

To date, this legislation has been stranded in a parliamentary committee for some 3 years under the influence of a government which may be reluctant to say NO but does not want to say Yes to us.

While the Government continues to insist that it will serve its full term, it is probable that the next General Election may be held in November – just weeks away. The likelihood is that the Bill will fall with the dissolution of the Dail but we are hopeful that it can be reintroduced in the next Dail.

With a general election due, the period between now and then is one where political parties will be more attentive to the needs of constituents and it is a good time to lobby all aspiring TDs.

What has been missing up to now is any show of strength by pensioners. Here is an opportunity and this is where you come in. Play your part and visit/contact the candidates for the election. Seek their support and commitment to the Bill or at least the Bill’s objective. Repeat that conversation with any candidate on your door-step. If a substantial majority of pensioners did this, politicians in government may pay more attention.

Attached is the final agreed version of a lobbying letter to prospective TDs in advance of the next General Election. This letter was prepared and agreed by the Reps group working under the aegis of the Irish Senior Citizens Parliament (ISCP).

I attach this letter to all branches for circul;ation to members and earnestly ask all members to use the letter for person to person lobbying with prospective TDs.

Thanks,

Tony Collins

NEC Chairman.

Up Coming General Election – A Message from The Irish Senior Citizens Parliament

THE IRISH SENIOR CITIZENS PARLIAMENT

Dear Deputy,

The Irish Senior Citizens Parliament (ISCP) is seeking the support of ALL Prospective General Election candidates for the Dail for The Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill 2021.

The ISCP are supported in this campaign by the Collective Network of Retired Workers, which comprises Retired Aviation Staff Association, ESB Retired Staff Association, RTE Retired Staff Associations, The National Federation of Pensioner Associations (NFPA) and Age Action. Our joint membership is approximately 5000,000 retirees from a wide cross section of organisations. We have been actively campaigning for this Bill for 3 years and are asking for your support to have this Bill passed.

The Bill, which has the support of opposition parties & Independents, has stagnated at the Joint Oireachtas Committee for Enterprise Trade & Employment.

We believe there is an attitude to senior citizens and the rights of those citizens which is discriminatory and ageist. Senior citizens need equality of esteem with other sectors of society.

Many occupational pensioners are suffering from pension poverty due to:

- Cuts to their income in retirement

- No pension increases at all, or increases well below inflation

- Loss of pay parity

- Imposition of Government pension levy

The importance of this Private Members Bill, The Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill 2021 cannot be underestimated. Retired Workers in Ireland do not have a voice or forum for redress on issues which can affect their current and future pension rights, entitlements, income security and protection in retirement.

The ISCP and the Collective Network of Retired Staff Associations can exert a great deal of influence when it comes to voting in elections as it comprises approximately 500,000 retirees from a wide cross section of organisations.

Reasons to support The Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill 2021:

- For many decades, the statutory authorities have consistently refused to recognise the collective voice of retired workers. Therefore, we cannot refer our collective grievances to any official structure. This exclusion must be rectified. Currently, the grievances of individual retirees must be referred to the WRC within six months of the complainant’s retirement and they must be limited to issues which arose during the complainant’s term of employment. The Financial Services & Pensions Ombudsman, Pensions Authority, Equality Tribunal or WRC/Labour Court do not provide a redress mechanism for retired workers as a collective.

- The 6-month limitation on pensioners’ access to WRC/Labour Court/Independent Forum is ageist and unfair and should be removed from both Equality and Employment legislation.

- The Bill will give a voice to retired workers over what happens to their occupational pension schemes after they have left their employment. At present, workers who have worked for decades in Civil and Public Services, State/Semi-State organisations, find that once they have left their employment any changes that impact their occupational pension schemes can happen without their input – No voice at the table, no negotiation rights and no procedures for pensioners.

- This Bill will give retired workers and their representative associations the right to go to the WRC/Labour Court/Independent Forum where their occupational pension in retirement can result in significant reductions in their income.

- Pensioners are not interested in interfering with the IR process but only in ensuring their voice at the table for those situations where pension rights/income are interfered with by other parties.

Redress mechanisms needed for retired workers

- For many pensioners, the pension promised by the sponsoring employer is a legitimate expectation and a condition of employment and for some the pension scheme is the vehicle for delivery of same.

- Employers need to engage with pension members collectively on pension issues thus creating equality of representation for all members of a scheme.

It is what this bill is about

Update 24th. May, 2024

ESB RETIRED STAFF ASSOCIATION

Please see attached Press Release, issued by Sue Shaw & accompanying document (Update 13th. May) which is designed to encourage all of our members to engage with the candidates on ESB RSA issues. In particular, it highlights the importance of asking where they and their party stand on the Industrial Relations Bill (Provisions in respect of Pension Entitlements of Retired Workers). A public meeting of the membership of all of the organisations, of which ESB is a member will take place in the Unite Trade Union Offices, details as follows:

Where: Unite Trade Union Offices When: Tuesday, May 28th. 55/56 Middle Abbey Street Time: 11.00 am Dublin

It is a special media event. There will be journalists & speakers from across all of the organisations affected by these pensions issues.Please come to this event and make your voice heard.

PRESS RELEASE

IRSIH SENIOR CITIZENS PARLIAMENT

FOR ATTENTION NEWS EDITORS.

What: Briefing session to retired employee associations on the progress of the INDUSTRIAL RELATIONS BILL

Where: UNITE TRADE UNION OFFICE, MIDDLE ABBEY STREET, DUBLIN.:

When: 11 AM TO 1 PM

The Collective Network of Retired Workers under the aegis of the Irish Senior Citizens Parliament are holding a briefing session for members on the current position of the INDUSTRIAL RELATIONS (PROVISIONS IN RESPECT OF PENSION ENTITLEMENTS OF RETIRED WORKERS) BILL 2021.

This will take place on the 28 th May @ 11.00 am. There will be short Press

Conference following the session in UNITE OFFICES Middle Abbey Street.

Speakers at the event are: Brid Smith TD (proposer of the Bill) Dr Nat O Connor

AGE ACTION; Pat Mellon ISCP, John Nugent and Paddy Fagan from the Collective Network.

The event aims to highlight the delays and lack of progress in relation to the

INDUSTRIAL RELATIONS (PROVISIONS IN RESPECT OF PENSION

ENTITLEMENTS OF RETIRED WORKERS) BILL 2021.

The Bill supports the rights of retired employees to have a say in any negotiations that will impact their pension provision. To date they have been left out of this process and this has resulted in pension poverty for many retired employees as there has been a cumulative effect over the years.

Retired employees believe that it is this Government plan to let them ‘age out’ before rights are granted. Many of the members who started this campaign have sadly passed away without seeing any change to the lack of equality for retired workers.

This Bill is the first serious attempt to address this inequality.

ENDS

CONTACTS for information/interview

John Nugent 0872079504; Joe Little 0872433209; Tony Collins 086 8197083; Paddy

Fagan 086 2251338

PRESS RELEASE

Update 13th. May, 2024

ESB RETIRED STAFF ASSOCIATION

To All delegates & Branch Secretaries

11 th May 2024

Dear Colleagues,

You are all aware of the imminent local & European elections next month and the fact that all prospective candidates are actively canvassing now.

With that in mind the National Executive are urging all members to use the opportunity to lobby any prospective candidates on the issues that are important to our Association.

WE ARE RETIRED WORKERS NOT RETIRED VOTERS

The importance of Brid Smith’s Private Members Bill, The Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill 2021 cannot be underestimated.

Retired Workers in Ireland do not have a voice or Forum for redress on issues which can affect their current and future pension rights & entitlements. These issues arise from agreements between employers and Trade Unions which can interfere with those rights. You will all remember the Pensions Agreement in 2010 between ESB Management and Trade

Unions, which excluded pensioners, but had a major impact on pensioners future financial security. This agreement eliminated pay parity with employees for pensioners without their agreement and the resulting lengthy pension freezes which effectively lasted for 12 years.

The above-mentioned Bill is seeking to address this injustice to pensioners. Workers have access to the WRC to arbitrate on issues they may have with their Employers.

What this Bill is attempting to do is to give pensioners a voice and access to a Forum similar to the WRC which could arbitrate on situations where pensioners rights & entitlements are being affected. Pensioners are not interested in interfering with the IR process but only in situations where pension rights are up for discussion.

The Collective Network of Retired Workers, under the aegis of the Irish Senior Citizens Parliament, which comprises all Commercial State & Semi State organisations including ESB, and the Alliance of Retired Civil & Public Servants, have been actively campaigning for this Bill for nearly 3 years now and are looking for the support of all the wider membership of these organisations to actively lobby all Public Representatives and prospective EU/Local election candidates.

There will be a public meeting of the membership of all these organisations in the Unite Trade Union offices 55/56 Middle Abbey Street on Tuesday 28 th May 2024 at 11.00 am. The meeting is intended as a media/publicity event with journalists in attendance and speakers from supporting organizations, such as Age Action.

All members of the organisations which comprise the Collective Network of retired Workers are urging their members to attend this meeting as a show of support & strength for the Industrial Relations (Provisions in Respect of Pension Entitlements of Retired Workers) Bill 2021 and the successful passing of this Bill into legislation.

SAVE THE DATE

ACTION FOR OCCUPATIONAL PENSIONERS’ RIGHTS.

Tuesday MAY 28 TH. 2024

UNITE TRADE UNION OFFICES

55-56 Middle Abbey St, North City, Dublin 1, D01 X002

11.00am-1.00pm

The following quote from a letter from Mairead McGuinness (MEP) to Clare Daly (MEP) highlights the protection of pensioners property rights in the context of their constitutional rights.

I am aware of the situation of the Irish Airlines (General Employees) Superannuation Scheme (IASS), including the 2020 judgment by the High Court of Ireland confirming that the interests of IASS pension scheme members within the trust affords them a property right enjoying constitutional protection. (’) This view is consistent with the case-law of the Court of Justice of the European Union. (2)

The Irish Government intend to implement a new Pensions Auto enrolment system in January 2025. This is very much a “buyer beware” situation for prospective members of the scheme, as how can the Government expect employees to buy in to such a scheme when existing pensioners have absolutely no voice or Forum to seek redress for situations where

their pension rights are being interfered with.

We need to look at the bigger picture here and the Irish Governments attitude to its senior citizens, the rights of those citizens, and the fact that they should have equality of esteem with other sectors of society.

Retired Workers in Ireland feel very strongly about the Irish Governments attitude to the rights of the older cohort of its citizens, an attitude, which they believe discriminates against older citizens and is ageist in the extreme.

The NEC are urging all members to lobby candidates on these particularly critical issues, which would benefit, not only ESB Pensioners, but ALL pensioners in Ireland.

Please ensure that this message gets the widest possible circulation in all your Branches and urge your members to conduct extensive lobbying of all candidates.

WE ARE RETIRED WORKERS NOT RETIRED VOTERS

Tony Collins

Chairman, National Executive

ESB Retired Staff Association

Update 12th. March, 2024

I attach a link to rip.ie for details of his funeralrrangement

Pl use to following link to access the funeral arrangements: https://rip.ie/death-notice/joseph-noel-kavanagh-dublin-tallaght

All Members – Beware of Financial Scams & Phising

It has come to our notice that some members have received shopping vouchers from some of our branches. When they tried to cash them in shops, there was no money on these vouchers. Subsequently, they have made contact with an attached email address in order to investigate the issue. This email address is belonging to a person who was never employed by ESB. We have reason to suspect that this is a financial scam. If you receive one of these, please Block, Delete and Do NOT RESPOND. NEVER CLICK ON A LINK & NEVER GIVE YOUR ACCOUNT DETAILS nor ACCESS PIN to anybody. If in doubt, ignore it.

CHECK YOUR DRIVING LICENCE

Your Driving Licence – Check the expiry date NOW

It has come to our notice that the NDLS (the authority who issue driving licences) are no longer sending out reminders for the renewal of licences. For the pensioners, most of whom are on short duration licences, 1, 2, or 3 years, it is very important that you are aware of your renewal date. If your licence is of the Credit Card Size type, your renewal date is listed as item 4b. You can renew up to 3 months prior to your renewal date and not suffer a time penalty.

You cannot legally drive a car without a valid licence and if you do, you will be subject to penalty points and a financial fine, the latter will depend on the duration from the renewal date. The accumulated penalty points will have insurance implications.

You can renew your licence up to 10 years after it it has expired. However if you exceed the 10 years, you will have to fulfill all the current requirements to obtain a new licence, theory test, learner permit, mandatory recorded training and pass a driving test.

Update 21st. Oct, 2023

Pension Scheme 2022 Annual Report

To get an emailed Copy or Hard Copy of Annual Report: Call OneHR at 01 7026699 option 3 or Email onehr@esb.ie Include your Name, Staff Number & state your preference.

Update 15th July, 2023

ESB MPF have requested that the following be put on the ESBRSA website.

MPF Annual Outpatient Claim 2023 [January and February]

Former ESB MPF members can now submit their Annual Outpatient Claim to ESB MPF for the first 2 months in 2023 (January and February 2023 i.e. for the period prior to the transfer of membership to Vhi).

It will be processed on a pro-rata basis i.e. the excess will be €60 (instead of €360) for a family membership and €46 (instead of €280) for a sole member. The allowable benefits will remain the same.

Claims should be sent by post to : ESB Medical Provident Fund, P O Box 384, Rosbrien, Limerick.

Update 19th, April 2023

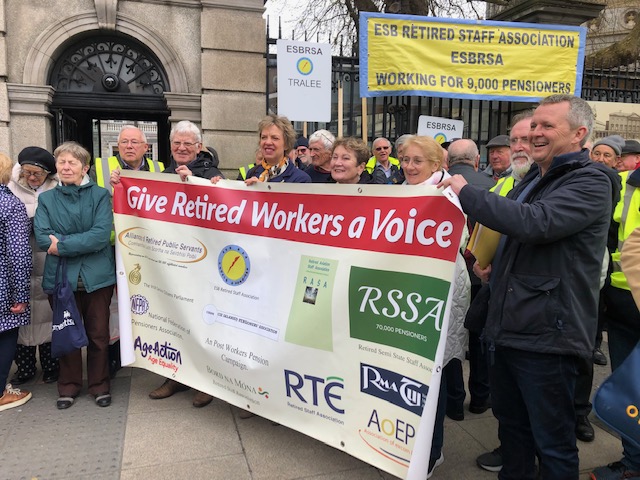

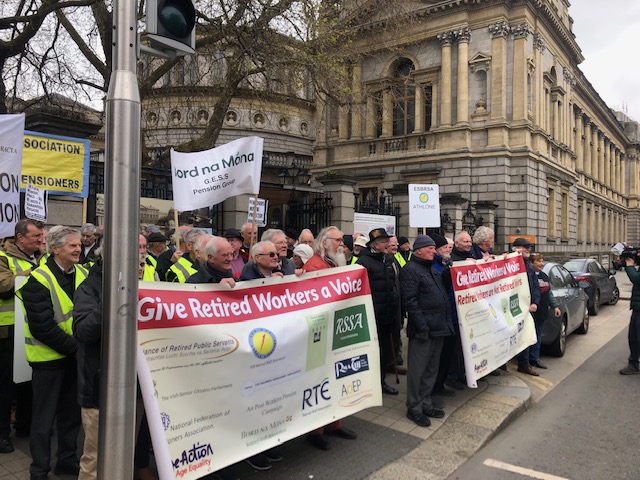

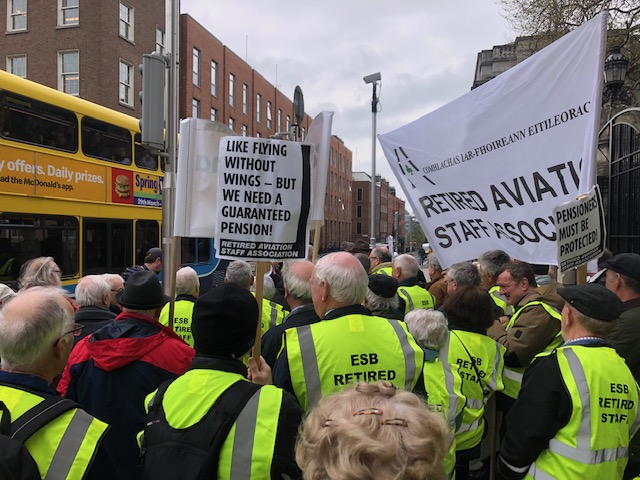

Photos of Demonstration supporting Pensions Bill at Dáil 19th April 2023 with thanks to James Lynch

Update 2nd, February 2023

ESB MPF has requested that the notice below be displayed on the ESBRSA Website for the assistance of MPF members.

Vhi are now issuing policy documents, containing your new Vhi policy numbers, to ESB MPF members who are transitioning to Vhi on 28th February 2023.

The dedicated Vhi ESB MPF concierge service is open to deal with any member queries relating to either the transition or the policy documents you have received.

The contact details for the service are 056 7753175 or by email to esbmpf@vhi.ie

They will also be pleased to help you with queries on your new Vhi plan benefits, cover for ongoing treatment or for new proposed treatment post 27th February 2023.

Update 31st, January 2023

The Joint Oireachtas Committee on Enterprise Trade & Employment held an open session last Wednesday on the pre-legislative scrutiny of the Industrial Relations Provisions in Respect of Pension Entitlements of Retired Workers Bill 2021, which was first read in the Dáil on 30th June 2021.ESBRSA Chairman Tony Collins was one of the witnesses speaking on behalf of ESB Retired Staff Association.

The link below will bring you to a recording of the hearing.

Tony’s opening statement begins at 32 minutes into the recording.

https://bit.ly/3XVNzXh

Update 24th, December, 2022

The National Executive Committee (NEC) wishes all members a peaceful and enjoyable Christmas.

Update 22nd, December, 2022

With regret we inform you of the death of Cathal Quinn on 21st December 2022. Cathal was formerly Area Supervisor ESB Athlone.

The RIP.ie notice for Cathal is below

https://rip.ie/death-notice/cathal-quinn-athlone-westmeath/519053

Update 2nd, December, 2022

Photo from the ESB MPF “Information Event” in ESB H.O. on Wednesday 30th November with thanks to Michael Hughes.

Update 1st, December, 2022

ESB Medical Provident Fund Virtual AGM Notice & Agenda

The 2022 MPF AGM will again be a virtual event this year.

The Trustees, in accordance with Rule 9.3, have convened the Annual General Meeting of the ESB Staff Medical Provident Fund for the following date and time:

Date: Monday 5th December 2022 Time: 5pm

If you are a member of the Fund and would like to attend, please email mpf@esb.ie (including your Policy or Staff Number in the email) or contact the MPF office at 061 430561 to receive your log in details. It will be an MS Teams event.

Agenda

1. Minutes of AGM held on 4 th November 2021

2. Adoption of Minutes

3. Trustees update for the year 2021

4. Audited Accounts for year ended 31 December 2021

5. Update on future direction of MPF 6. Any Other Business

Update 4th November, 2022

To All ESBRSA Members’

The email message below issued today Friday 4th November to members of ESB MPF

MFMedical Provident Fund (Enterprise Services) <mpf@esb.ie>Fri 04/11/2022 14:43

November 2022

Dear Member,

Welcome to our third newsletter of 2022 where we share with you relevant information about your fund and provide you with notice of the ESB MPF AGM.

ESB MPF AGM 2022 Notice

The ESB MPF AGM will again be a virtual event this year and will be held on Monday 5th December 2022 at 5pm (details on how to register your intention to attend the AGM are noted below).

Fund Update

In our last newsletter, I advised that an agreement had been reached with a provider which the trustees believe will ensure that our members continue to receive top-class health cover. I am happy to confirm our provider of choice as Vhi Healthcare. The Medical Provident Fund membership will transfer to Vhi Healthcare effective from 28th February 2023.

The necessity for change and why the trustees embarked on this process has been communicated regularly at MPF AGMs and in newsletters. Some of these reasons include:

- The ageing profile of the fund members and the difficulity in recruiting new members thus resulting in a continuously falling membership number

- MPF is excluded from the risk equalisation scheme which would grant access of up to €9m additional funds per year for the Fund – in essence the market saying we need that to survive

- MPF has a restricted membership licence which means we can’t source membership from the open market and child associate members cannot remain indefinitely in the fund

- The continuing and significant increases in cost of private medical care

We are delighted to be partnering with Vhi Healthcare knowing that this partnership will give us access to cutting edge benefits and services, offering you a healthcare experience unlike any other. The following are just some of the key benefits you will have access to:

- Comprehensive public and private hospital cover

- Cash back for a range of day-to-day medical expenses

- Exclusive access to the Vhi 360 Network; providing access to services including urgent care, diagnostics & health screening

- Access to Vhi Hospital@Home

- Overseas cover

- Vhi App – Access Snap&Send claiming, Vhi Online Doctor and much more

In order to assist you with the transition to Vhi Healthcare, we have scheduled a number of dedicated information events. At these events, you will have an opportunity to learn all about the proposed new arrangement including the benefits, cost arrangements and how the risk reserve will be used for the benefit of all members. The dates for the upcoming events are as follow:

Monday 21st November 2022 @ 5pm – Virtual meeting held on Microsoft Teams

Wednesday 23rd November 2022 @ 5pm – Limerick (venue to be confirmed)

Thursday 24th November 2022 @ 5pm – Cork (venue to be confirmed)

Tuesday 29th November 2022 @ 5pm – Athlone (venue to be confirmed)

Wednesday 30th November 2022 @ 5pm – ESB Head Office, F27, Dublin

Monday 5th December 2022@ 5pm – AGM – Virtual meeting held on Microsoft Teams (including dedicated information update on partnership attended by VHI Healthcare team)

The in-person meetings are obviously subject to covid and should there be a change in circumstances will be transferred to being online.

If you would like to attend any of the above sessions, it is necessary to contact the MPF administration team to confirm your attendance. This can be done via phone by contacting 061- 430561 or by email [stating name, ESB staff number and event you wish to attend] to mpf@esb.ie and we will then arrange to furnish you with login details and/or the venues for the information event you wish to attend.

It is also important to note, on 9th January 2023 your information will be sent to Vhi Healthcare to ensure a hassle-free experience for you and to maintain continuity of cover. Please note only the minimum essential information will be forwarded and it will not contain any medical or bank details. If you would prefer that your information (or that of any member you subscribe for) is not sent, please notify the MPF Admin Team in writing or by email by 31st December 2022. You will receive your VHI Healthcare policy documents in early February. You can make changes or cancel your Vhi Healthcare policy up to 14 days following your renewal date of 28th February 2023.

I look forward to engaging with you at the events and AGM over the coming weeks and addressing any questions or feedback you may have.

Best Regards,

Pensions and Insurance Manager

Update 31st October, 2022

Dear Member,

All Medical Provident members will have received a newsletter last July concerning an agreement that had been reached between Trustees of MPF and an unnamed medical insurance provider to provide continuing and improved medical cover for MPF members. There was a promise to contact members about various upcoming dedicated information events and number of on-site meetings where the Trustees will share in detail the outcome of their fund review process.

RSA sent a letter (see letter below) to James O’Loughlin, Manager MPF on 25th July, outlining the concerns of pensioners regarding the future of MPF and this proposed alliance with another insurer.

To date RSA have not received a response to that letter or subsequent reminder letters, nor has there been any communication from MPF re information meetings. The MPF Manager has, however, recently been in contact offering a face to face meeting with some members of RSA Executive Committee on 15th November, which we are accepting.

This is a very serious situation facing MPF and its membership with the lack of any clear communication from MPF Management causing speculation and serious concern to members, so we urge all members to be vigilant and to make their views known to MPF Management.

RSA are also aware that there will be an MPF virtual AGM on 5th December and would urge all members to register for that event when the notification arrives from Medical Provident Fund.

Mr. James O’Loughlin

Manager, Medical Provident Fund

25th July 2022

Dear James,

I refer to your email to me of 14th June and your subsequent briefing note/newsletter received 18th July. That newsletter states that an agreement has been reached between MPF Trustees and a health insurance provider.

The lack of any detail as to the nature of this deal and whether or not it is subject to ratification by the unnamed insurer and by MPF/MPF members is causing our members considerable concern who fear it is a case of a done deal, already concluded, with only briefing to follow.

Partnership implies the continuing existence of both the MPF and the chosen insurer. Under a proposed new partnership arrangement.

· The identity and status of MPF members should not be diminished in any way

· If MPF are to be net beneficiaries of the Risk Equalisation process, then it should follow that MPF members benefit from reduced premiums.

· Fund reserves belong to MPF members so before any new partnership arrangement is finalised, a mechanism should be put in place to give members the full benefit of those reserves, bearing in mind those members who have contributed most to building the reserve fund.

· How will MPF will be administered going forward, and will Trustees continue to play an important role, representing the interests of the members.

The importance of All MPF members being fully informed of the details of this agreement before any such information events are held should not be underestimated. RSA request that arrangements be made without further delay as follows

· To end the current information vacuum with respect to this proposed deal we ask that a document setting out the details be sent to all members prior to any meetings being organised as this will make the meetings more useful and productive

· Organisers of the forthcoming information meetings should be very mindful of the age profile of MPF members and that for many, virtual meetings are wholly inappropriate. Where onsite meetings are being considered, the locations for these meetings should be fully accessible by public transport and held at a reasonable time of day to suit elderly members.

· On completion of the review process, any changes in the terms and conditions of MPF membership should be subject to the approval of ALL members of MPF.

Jim Devlin, Secretary

Update 20th October, 2022

ESBRSA has written to ESB following the decision not to consult with Retired Staff Members on new Rules of the DB Pension Scheme. We have also written to Eamon Ryan, Minister for the Environment, Climate, Communications and Transport asking him to defer approval of the new rules until there has been consultation with Retired Staff Members. The letters are below.

1. Letter to James O’Loughlin, Group Pensions & Insurance Manager re exclusion of pensioners from the 21 day consultation process on the proposed Pension Scheme rule changes following the implementation of the IORPS11 European Directive on pensions. RSA were engaged in a Joint ESB & RSA Forum for over 8 years at which they were assured that exclusions such as this, would not happen again after the debacle around the 2010 Pensions Agreement, where pensioners were excluded from being a party to that agreement. It seems these words are meaningless.

2. Letter to Eamon Ryan, Minister for the Environment, Climate, Communications and Transport, also re exclusion of pensioners from the 21 day consultation process on the proposed Pension Scheme rule changes following the implementation of the IORPS11 European Directive on pensions with a request not to approve the ESB Pension Scheme rule changes until the consultation process is rerun to include pensioners.

4th Oct 2022

Mr. James O’Loughlin,

ESB Pensions and Insurance Manager,

Dear James,

I and other pensioners have recently learned of the current consultation process on new rules to the DB pension scheme.

I wish to protest vigorously the exclusion of pensioners from this formal consultation process.

Any rule changes impinge on pensioners every bit as much as on employee members of the scheme and pensioners are as deserving of the same consideration as employees.

This yet again sets to naught management’s words in the joint ESB/ESBRSA forum that the exclusion of pensioners from the process as occurred in 2010 would not be repeated but, of course, it is not the first time that this exclusion has recurred.

The attitude and behaviour of ESB towards it pensioners leaves a lot to be desired and badly reflects on ESB and needs to change.

ESB operates a dignity at work policy. Does that policy existence and content represent core values toward people? It is hard to accept that it is given the continuing exclusion of pensioners from pension matter affecting them.

Finally, I call on ESB to re-run this consultation process and open it to all members of the Scheme.

Yours sincerely,

Jim Devlin, H. Sec., ESBRSA

Copy: Mr. Paddy Hayes, CE, ESB

4th Oct 2022

Attn: Minister for the Environment, Climate and Communications, Minister for Transport

Dear Minister Ryan,

ESB Defined Benefit Pension Scheme has some 12,000 members of who only 1 in 4 is an employee member. Currently ESB is engaged in a formal 21 day consultation process concerning revised rules to the scheme following their approval by ESB board. These rule changes are to comply with new IORP II requirements as per Irish regulations of last April. The consultation process commenced 14th Sept 2022 and ends tomorrow 5th Oct. The next step is to seek ministerial approval.

I am writing to you today to request that you defer approval and require ESB to re-run the consultation process. The reason I make this request on behalf of ESB pensioners and our organisation, which represents ESB Retired Staff, is that ESB has issued the consultation document to employee members of the scheme only. Not alone have pensioners been ignored but when I, as a pensioner, sought from ESB Pension Office a copy of the new rules I was told “The new rules process is only open to active staff [i.e., employees], so no copy is currently available to pensioners”

Any revision to the rules applies equally to all members of the scheme. Pensioners are equally deserving of being consulted as employee members are.

I conclude by repeating my request on behalf of all ESB pensioners that you defer approval and require ESB to re-run the consolation process in the interests of equality of treatment for pensioners and respect for their views on the rule changes.

I attach also a letter sent today to ESB.

Yours faithfully,

Jim Devlin, H. Sec., ESBRSA

Update 12th October, 2022

Photos taken at the September Annual General Meeting of ESBRSA Head Office Branch. With thanks to Michael Hughes

Update 30th September 2022

At a recent Dublin H.O. Branch meeting a presentation on the “Fair Deal” scheme was made by Mary Courtney. Her slides are available via the link below.

http://www.esbrsa.ie/wp-content/uploads/2022/09/Fair-Deal-Module-ESB.pdf

Update 21st August 2022

The following is a letter sent to Manager, Medical Provident in response to the newsletter received by all members on 18th July 2022.

Mr. James O’Loughlin

Manager, Medical Provident Fund

25th July 2022

Dear James,

I refer to your email to me of 14th June and your subsequent briefing note/newsletter received 18th July. That newsletter states that an agreement has been reached between MPF Trustees and a health insurance provider.

The lack of any detail as to the nature of this deal and whether or not it is subject to ratification by the unnamed insurer and by MPF/MPF members is causing our members considerable concern who fear it is a case of a done deal, already concluded, with only briefing to follow.

Partnership implies the continuing existence of both the MPF and the chosen insurer. Under a proposed new partnership arrangement.

· The identity and status of MPF members should not be diminished in any way

· If MPF are to be net beneficiaries of the Risk Equalisation process, then it should follow that MPF members benefit from reduced premiums.

· Fund reserves belong to MPF members so before any new partnership arrangement is finalised, a mechanism should be put in place to give members the full benefit of those reserves, bearing in mind those members who have contributed most to building the reserve fund.

· How will MPF will be administered going forward, and will Trustees continue to play an important role, representing the interests of the members.

The importance of All MPF members being fully informed of the details of this agreement before any such information events are held should not be underestimated. RSA request that arrangements be made without further delay as follows

· To end the current information vacuum with respect to this proposed deal we ask that a document setting out the details be sent to all members prior to any meetings being organised as this will make the meetings more useful and productive

· Organisers of the forthcoming information meetings should be very mindful of the age profile of MPF members and that for many, virtual meetings are wholly inappropriate. Where onsite meetings are being considered, the locations for these meetings should be fully accessible by public transport and held at a reasonable time of day to suit elderly members.

· On completion of the review process, any changes in the terms and conditions of MPF membership should be subject to the approval of ALL members of MPF.

Jim Devlin, Secretary

Update 19th August 2022

RSA has learned that an increase of 3.7%, being the rate of inflation Sept 2020 to Sept 2021, will be paid. There is no further information at this time as to when it will be paid.

Update 11th August 2022

The new ESB Head Office now referred to as F27 ( 27 Lr. Fitzwilliam Street Dublin 2) is now completed.

It may be of interest to retired staff to know that the Bialann / Restaurant is accessible to them. In order to gain access it is necessary that you take a short induction course for Health and Safety purposes at the reception desk.

The Bialann opens for lunch at 12:00

Update 21st June 2022

ESBRSA took part in the Cost Of Living Coalition (COLC) march on June 18 2022 to highlight the plight of ESB Pensioners whose pensions have fallen far behind the Pension Promise and are being eaten into by spiralling inflation.

The link below will bring you to the RTÉ news report on the march.

Update 13th April 2022

Matt Kelly

Dear Members,

The recent issue of Pension Pay Advice slips added overdue retrospection payment to normal pension payment without identification of the retrospection and the tax years during which they should have been paid.

Two emails were sent to ESB Pensions Manager James O’Loughlin about the matter.These emails are copied below..

I intend to email ESB asking for a written certification of the amount of retrospection for each of the years during which they should have been paid so that I may submit it to Revenue. Perhaps if we all do that it will solve a problem that should never have arisen and avoid a repetition in future.

Kind Regards

ESBRSA Website Admin.

Below are two letters sent to Pensions Manager, James O’Loughlin, by Tony Collins, Chairman National Executive, ESBRSA

Dear James,

Further to yesterday’s email, I & my colleagues have received more queries regarding the payment of the pension increase and the manner in which it has been displayed on the payslip.

The retrospective element of the increase spans a number of years and should have been displayed on the payslip showing the amount of retrospection in respect of each year.

Many pensioners in normal circumstances with an average monthly/weekly pension payment are very close to the threshold of the higher tax rate and a lump such as the one just paid will move them into the higher tax bracket. Consequently, they will pay the higher tax rate on their lump sum when in reality if the increase was paid in a timely fashion they would have been taxed at the lower rate.

To be fair to all pensioners consideration should have been given to the above when the pension increases were being applied.

ESBRSA believe that ESB Payroll has a responsibility in this regard and should take steps to rectify the situation by informing pensioners of the correct amount of retrospection in respect of each tax year.

I look forward to hearing your response and that of ESB Payroll on this matter.

Sincerely yours,

Tony Collins

Chairman, National Executive

Dear James,

I hope you and yours are keeping well. Most pensioners will have received their pension payslips by now. I know ESBRSA have received a number of complaints/comments at this stage.It never ceases to amaze me how some people get things so wrong at times.When the previous pension increase of 0.2% was paid some years ago, also in arrears, ESBRSA wrote to you regarding the confusion caused by the layout of the payslip, the retrospective element of the increase was included in the gross pension amount and some pensioners thought that they had received a larger increase than they actually did. Can you imagine their shock/surprise when they realised it was only 0.2%. ESBRSA had to write to our network of branches to explain the payslip.The recent increase has been paid in exactly the same manner. To err once is human, to err twice is careless. When I worked in a wages unit in ESB more than 50 years ago we had a simple basic wages system, but if a wage increase was paid in arrears, the retrospection was displayed separately on the payslip, which was self-explanatory. I fail to understand why, with the sophisticated online real-time payroll system in ESB now, what should be a simple task, appears complicated to the employee/pensioner.The late payment of the pension increase more than 3 years in arrears, apart from being disrespectful of pensioners, particularly the hundreds of those who have passed away in the last 3 years or so and never had the benefit of the increase, also presents another problem in that lump sum payments can mean some pensioners move into a higher tax bracket. We have already received a complaint in that regard at this early stage.On behalf of all pensioners I ask that you consider the above and get it right next time, when the next increase is paid, i.e the 3.7% due from 1st January 2022. Please don’t delay this payment further, as many pensioners are now feeling the effects of the serious increase in inflation and the increased cost of living.

Sincerely yours,

Tony Collins, Chairman, National Executive, ESB Retired Staff Association

Update 8th April 2022

Hello Everyone,

Many Thanks to Freida Murray who asked that we to circulate this lovely Acknowledgement from Margaret Shanahan, wife of the late Liam Shanahan retired, ESB Networks, Distribution Dept., ESB Projects Department and ESBI. We were all saddened when Liam bravely passed away last November, following a prolonged illness.

Thank you from Margaret Shanahan

Dear All,

I would like to take this opportunity on behalf of all my children, grandchildren and extended Shanahan family, to say a very big thank you to all the ESB friends and colleagues that Liam had throughout his lifetime.

Liam would’ve been very proud to receive your beautiful sentiments and memories of him.

Courage, dignity and humour were mentioned so many times, that’s the only way to remember Liam for sure.

Kind Regards,

Margaret Shanahan

Update 25th March 2022

Dear Member,

The Industrial Relations Provisions in Respect of Pension Entitlements of Retired Workers Bill 2021

The Irish government has launched a consultation process on the above Bill, which was first introduced by Brid Smith (PBF) in the Dail on 30th June 2021, and proposes to give retired workers’ access to industrial relations mechanisms for pensions related issues.

The consultation, launched by the Minister of State for Business, Employment and Retail, Damien English TD, will run until Friday 22 April 2022.

The Department are seeking the views of interested parties on a proposal for the introduction of a statutory right for retired persons to be included in collective trade disputes, and how to balance the proposed new rights for retired persons with the current rights and interests of workers and employers who engage in the bargaining process.

The government intends to review submissions by mid-May with further direct stakeholder engagement, including with representative organisations. The outcome of the consultation will feed into the government’s response to the proposals.

The Collective Network of pensioner organisations under the banner of the Irish Senior Citizens Parliament (ISCP) will be making a submission to this process on behalf of all the constituent organisations of the Collective Network.

ESBRSA will also be making a submission as part of this process, so if any of our members wish to contribute to this submission please contact our website coordinator on info@esbrsa.ie and your views will be forwarded to the Executive Committee.

All organisations representing retired workers will be encouraged to make a submission in support of the views put forward by the Collective Network.

Please see below for the template released by the Department for making submissions.

——————————————————————————————————————–

Public Consultation on Retired Workers Access to Industrial Relations Mechanisms for Pension Related Issues

The purpose of this consultation is to seek your views on proposals arising from a Private Members Bill for the introduction of a statutory right for retired persons to be included in collective trade disputes and how to balance the proposed new rights for retired persons with the current rights and interests of workers and employers who engage in the bargaining process, along with considering;

- What, if any, additionality could the proposals provide to the existing protections for retired persons including those provided by the Pensions Authority, the Financial Services and the Pensions Ombudsman;

- The effectiveness of the existing timeframe which already allows a retired person access to the industrial relations bodies in a period of 6-months post-retirement for matters arising pre-retirement please see section 26A Revised Acts (lawreform.ie) and

- Whether there is the potential for new or enhanced methods of consultation through the introduction of alternative systems, networks or fora which might assist retired workers in engaging more fully on pension related issues.

The document provides space for your responses to the questions set out.

Your Name: _____________________________________________________

Organisation (if applicable): ________________________________________

Telephone Number: ______________________________________________

E-mail: _________________________________________________________

Please indicate if this submission is made in a personal/employee capacity, an employer capacity or on behalf of your institution, organisation or group.

Name of company, institution, organisation or group covered by this submission:

Respondents are requested to make their submissions by email to: irsection@enterprise.gov.ie

The closing date for submissions is Friday 22nd April at 3pm. ________________________________________________________________

I. Background

The Government has agreed to carry out a consultation to allow for full consideration of the proposals as set out and the possible implications of these. Part of this detailed consideration also involves a consultation process with the other relevant government departments, representative organisations, trade unions and employer bodies.

To ensure that the views of all stakeholders are considered, submissions are now invited during a six-week public consultation period from Friday 11th March to Friday 22nd April 2022.

Submissions will be reviewed by mid-May with further direct stakeholder engagement, including with representative organisations, scheduled as required. The outcome of the consultation will feed into the Government’s response to the proposals.

II. Existing Protections for Retired Workers’ Pension Entitlements

Protections Under the Pensions Act

Section 50 of the Pensions Act 1990 provides that the Pensions Authority may make a direction to reduce pension benefits payable to, or respect of, all scheme member cohorts (active, deferred and pensioner members) in order to satisfy the funding standard, and continue to allow the scheme to operate.

There are limits in respect of the amount by which pensioner benefits can be reduced. With effect from 25 December 2013:

- No reduction may be made from an annual pension of €12,000 or less and no reduction may be made which reduces an annual pension to below €12,000.

- If an annual pension is over €12,000 and less than €60,000, a reduction may be made by a percentage no greater than 10% and to an amount which is no less than €12,000.

- If an annual pension is €60,000 or more, a reduction may be made by a percentage no greater than 20% and to an amount which is no less than €54,000.

The 2013 changes were designed to spread the risk of scheme underfunding to all scheme member cohorts and to ensure a more equitable sharing of scheme resources where restructuring is required while still providing for significant protections to pension benefits already in payment.

While pensioner members have a protection in law in respect of their pension benefits over and above the protection offered to active and deferred members protections there are also opportunities to make submissions to the trustees of a scheme in the context of scheme restructuring.

Other Protections

There are also safeguards available to retired workers particularly given that pension entitlements are property rights and protected in the courts.

In addition, the Pensions Authority plays an important regulatory role in relation to occupational schemes and the Financial Services and Pensions Ombudsman adjudicates on pension appeals taken by individuals as an avenue to vindicate their rights.

Opportunity for Member Submissions

Current legislation provides that prior to the trustees of a scheme making a section 50 application to the Pensions Authority which could involve reductions to pension payments payable under a scheme, they must consult with the employer, the scheme member, with pensioners and with the authorised trade union representing members.

Trustees must undertake a comprehensive review of the scheme with a view to the long-term stability and sustainability of the scheme. In advance of any application, the trustees must notify members and beneficiaries of the scheme, including pensioners, in writing, of matters relating to the proposed application and provide an opportunity for such persons to make submissions to the trustees. Furthermore, the trustees must in accordance with the Prescribed Guidance in Relation to Section 50 of the Pensions Act, 1990[1], give due consideration to these observations.

In the event that the Pensions Authority makes a Section 50 direction, other than on application by the trustees, legislation also provides that the trustees must notify all member cohorts, and provide an opportunity for members, including pensioner members to make a submission/ an appeal in respect of this direction. Furthermore, in these circumstances, the Authority shall, prior to making such a direction, consider the submissions made.

While the opportunity for member submissions and consideration of these submissions is provided for, it is important to note that trustees may need to act in a timely fashion to ensure the long-term stability and sustainability of a scheme.

III.Publication of Consultation Submissions and Freedom of Information

Any personal information, which you volunteer to this Department, will be treated with the highest standards of security and confidentiality, strictly in accordance with the Data Protection Acts 1988 and 2018. However, please note the following:

- The information provided in the submission form will be shared with relevant Government Departments and State organisations during the review process.

- The Department will publish the outcome of the reviews and the submissions received under this consultation on its website, and

- As information received by the Department is subject to the Freedom of Information Act, such information may be considered for possible release under the FOI Act. The Department will consult with you regarding such information before making a decision should it be required to disclose it.

- If you wish to submit information that you consider commercially sensitive, please identify that information in your submission and give reasons for considering it commercially sensitive.

IV. Note Regarding Responses

Respondents are encouraged to keep their responses within the box accompanying each question. Please answer any questions that are relevant to you or your organisation.

Question 1: Duties of Pension Scheme Trustees

Pension scheme trustees have duties and responsibilities under trust law, under the Pensions Act 1990, as amended, and under other relevant legislation. The duties of pension scheme trustees include administering the scheme in accordance with the law and the terms of the trust deed and scheme rules as well as ensuring compliance with the requirements that apply to these schemes.

Pensioner members may avail of that opportunity to become scheme trustees or nominate others to act on their behalf. However, national and European law prohibits discrimination in the manner in which trustees are appointed.

Once appointed, trustees have a fiduciary duty to act in the best financial interest of all scheme members, whether active, deferred or retired, and must serve all beneficiaries of the scheme impartially. If there is a conflict of interest, then a person’s duty as a trustee must, in law, take precedence over other interests.

Accordingly, any trustee who acts in the interests of one cohort of members, e.g., pensioner members, above the interests of other member cohorts of the scheme would be in breach of his or her fiduciary duty.

| Given the legal and regulatory obligations imposed on pension scheme trustees (see: section_50_-_prescribed_guidance_-_version_3_february_2015_.pdf (pensionsauthority.ie), in particular, their fiduciary duty to serve all scheme members impartially, and the opportunity for member submissions as part of any scheme restructuring process, what is the effectiveness of the current arrangements and are there any other suggestions as to how the interests and concerns of retired workers could better inform trustees in their work consistent with the existing legal framework? |

Question 2: Access to Industrial Relations Mechanisms for Retired Workers on Pension Matters

The 1990 Industrial Relations Act currently allows a retired person to access to the industrial relations bodies in a period of 6-month post-retirement for matters arising pre-retirement.

This 6-months is either from the date of retirement or the date from when it became known or should have been known, the time frame in which to make a complaint for matters arising post-retirement. This may be extended by the Labour Court in exceptional circumstances on a case-by-case basis, where the justice of the case so requires.

| Is there a need for the views of retired worker members of pension schemes to be included in the consideration of pension entitlements as part of collectively bargained agreements; if so, how can this be best achieved? Are there any mechanisms that could provide a way for retired worker members of pension schemes to engage with pension trustees in advance of a separate collectively bargained agreement impacting on pensions? Are there any disadvantages or challenges that introducing such a mechanism might impose on the voluntary dispute resolution mechanism? If so, what are these? Could there be any deterrent effect of such a mechanism on the willingness of parties to engage in collectively bargained agreements and as part of the existing IR structures more generally? |

Question 3: Retired Workers and Collective Bargaining

| Could the views of retired workers be balanced with those of workers and employers engaged in negotiations to reach collectively bargained agreements? If so, on what basis? |

Question 4: Implications for Workers and Employers

Question 5: Redress Mechanisms for Retired Workers