The National Executive of ESB Retired Staff Association wishes to extend Christmas and New Year wishes to all members of the Association and to thank you for your support during 2024. We wish all our members and their families a very Happy Christmas and a peaceful and healthy New Year.

Tony Collins

Chairman, National Executive

ESB Retired Staff Association

UPDATE 15th January, 2021

We have been advised by Bríd Smith TD PBP that she will be introducing a proposed bill entitled Industrial relations amendment (Provisions in Respect Pension Entitlements of Retired Workers) Bill 2020 the Dail.

Briefly the bill aims to give greater representative rights for retired workers and their representative organizations when it comes to issues around their occupational pension schemes. It does this by changing certain clauses in the Industrial Relations act to expand the time period in which retired workers can take a case to the WRC for example and by changing the definition of trade dispute, strike and by adding organizations representing retired persons to other clauses in order to expand their rights.

The National Executive Committee (NEC) wishes all members a peaceful and enjoyable Christmas.

UPDATE 15th December, 2020

The information below in relation to Covid-19 Vaccine was received via the Irish Senior Citizens Parliament

Many Thanks to Tony Smyth, Dublin Region Secretary, for bringing it to our attention.

Importance: High

COVID-19 Vaccine on the Horizon

Dr. Ronan Glynn, Deputy Chief Medical Officer, Department of Health

2020 has been an incredibly difficult year for everyone. But this has also been a year of very significant medical and scientific achievement in which a new illness has been characterised, its genome sequenced, and diagnostics and treatments have been developed.

And now, subject to authorisation by the European Medicines Agency, Ireland is on the cusp of deploying at least two COVID-19 vaccines as part of a national vaccination programme.

Many are now asking, how has it all happened so quickly? Afterall, we know that, normally, it takes about 10 years to develop a new vaccine, to make sure it is safe and effective, and to make enough of it for everyone who needs it.

There are several reasons why this timeline has been really cut down for COVID-19 vaccine candidates.

First, there have been enormous levels of investment and scientific and medical research, on a scale never previously seen in vaccine development.

Second, because of the high number of new cases of Covid-19 across the world, the vaccine trials were able to quickly measure differences in disease risk between those who received the vaccine and those who got the placebo or dummy vaccine.

Third, many of the processes which normally take place one after the other in vaccine development have instead been running in parallel. For example, large scale manufacturing of vaccines started even before the results of phase 3 trials were available. Similarly, regulators and those developing the vaccines started their conversations very early in the process so that the regulators were aware of developments and so that the process of authorisation can now be as swift as possible.

None of these factors imply that safety, scientific or ethical integrity have been compromised, or that short-cuts have been taken.

People should take great encouragement from these developments and we can be confident that the successful implementation of this programme will mark a significant advance in our approach to this pandemic. However, there are still many uncertainties and barriers to be overcome.

First and foremost, people must be willing to get vaccinated. Our research tells us that the majority have already decided that they will definitely (45%) or probably (28%) take the vaccine when it is offered to them.

Of course, many people will have questions. They will no doubt be faced with rumour and misinformation, particularly online. To counter this, transparency and trust must be the cornerstone of our approach to addressing uncertainties and building vaccine confidence. Healthcare professionals – our doctors, nurses, pharmacists and allied health professionals – all across the country will have a central role to play in this process, just as they have been the foundation upon which the entire response to COVID-19 to date has been premised.

As we face into Christmas and the New Year, there are many reasons for hope, not least of which has been our demonstrated solidarity and willingness to listen to public health advice and thereby protect ourselves and others. Through people’s collective efforts we have avoided to the greatest extent possible the devastating impact that COVID-19 has had across Europe over the past two months, with greater levels of mortality than those experienced last Spring.

But we are not through this yet. This virus doesn’t care that we have done well recently. It doesn’t care that we are tired or that we are desperate to see our families and friends. It is no less dangerous now than it was last March. A vaccine will not have any positive impact on the trajectory of this disease for months to come. In the meantime, we must continue to hold firm; to paraphrase Mike Ryan, we need to continue to do all we can to save lives now, not the lives we promise to save next year. Let’s see this through together.

ENDS//

Press and Communications Office

An Roinn Sláinte

Department of Health

Bloc 1, Plaza Miesach, 50 – 58 Sráid Bhagóid Íochtarach, Baile Átha Cliath, D02 XW14

Block 1, Miesian Plaza, 50 – 58 Lower Baggot Street, Dublin, D02 XW14

T +353 (0)1 635 4477

UPDATE 13th December, 2020

The following links will bring you to two pages of a document issued by the Senior Citizens Parliament which were included with the ESBRSA Cork Branch Newsletter.

UPDATE 11th December, 2020

The link below will bring you to the 2020 ESBRSA Cork Branch Newsletter for December 2020. The link is also available in the Cork Branch page.

2020 ESBRSA Cork Newsletter Dec 2020

UPDATE 8th December, 2020

With regret we inform you of the death of Leslie Rogers formerly of ESB Transmission Department Merrion Square. Leslie worked for the ESB from age 18 until his retirement from ESB Transmission aged 55 ca. 1990. He passed away last Friday 4th December 2020.

RIP.ie notice for Leslie Rogers Cabinteely Dublin

UPDATE 7th December, 2020

With regret we inform you of the death of Paul Fagan ex ESB Inchicore TOD.

RIP.ie link for Paul Fagan South Circular Road Dublin

UPDATE 27th November, 2020

Further to the update below on 12th November 2020 ESBRSA has commented on the Video Presentation as follows:

ESBRSA Comments on Trustee Question & Answer Session

This year the Pension Scheme Trustees decided to make a prepared video presentation available to members to replace the Trustee events of previous years. Scheme members were invited to submit questions for the Trustees. The Trustee Chairman, Tony Donnelly, made the presentation on the Question & Answer session. What actually happened during the presentation was that he categorised the questions under various headings and chose to answer some questions, ignored others, or further still, put his own interpretation on the question and gave whatever answer he saw fit in order to get his own or ESB’s message across to members.

This was a propaganda exercise on the part of Trustees and ESB, yet again, extolling the virtues and benefits of the 2010 Pensions Agreement as the saviour of the Pension Fund.

Pensioners were not party to this Agreement nor did they have an opportunity to accept or reject the terms of this Agreement, hence the title and quote “Agreement Between ESB and the Group of Unions Representing Staff, on the Issues of Pension Review and Related Matters 2010”

The full document outlining the terms of the 2010 Pensions Agreement Between ESB and the Group of Unions Representing Staff can be found by using the links at the bottom of this posting

The only references to Pensioners in the Agreement can be found under the following headings and extracts from the Agreement

- Pensions in Payment

A Pension freeze will apply up to 31st December 2013. Thereafter pension increases will apply from 1st January each year and be based on the level of annual price inflation as measured by the previous year’s CPI (September to September, as published by the CSO), subject to a cap of 4%. The increases will be conditional on passing a solvency test. In relation to all of the above there is no facility for the payment of any catch-up increases.

Solvency Test for the Payment of Pension Increases from 2014

“ The solvency level under the Ongoing Actuarial Valuation is 100% or greater after allowing for payment of the proposed pension increase”

Comment on Trustee answer to solvency test

ESBRSA would take issue with the Trustees views on the solvency test as it is now applied by the Scheme Actuary. The Trustee Chair clearly stated that pension increases have not been awarded because the Minimum Funding Standard deficit, which, including a Risk Reserve, stands at in excess of €700 million at the end of 2019.

This statement by the Trustees is misleading, because according to the terms of the Pensions Agreement, the solvency test is based on the Ongoing Actuarial Valuation only, and NOT on the Minimum Funding Standard. The trustees are clearly in breach of this Agreement, with regard to the criteria used to determine whether a pension increase can be awarded or not.

In addition, the practice of including all future year pension increases in a solvency test under the Ongoing Actuarial Valuation, to determine whether a pension increase can be granted in a single year, is, in ESBRSA’s opinion, a seriously flawed approach by the Scheme Actuary. It continues to block pension increases, which are dependent on 100 % solvency. For the purposes of calculating solvency in any given year, pension increases for that year only should be included. This practice has a serious negative impact on the potential for pensioners ever getting an increase in their pensions in the future.

According to the Pensions Agreement, pension increases should have applied from 1st January 2014 onwards, subject to a solvency test, but in RSA’s opinion, the approach to the solvency test is seriously flawed.

Staff have benefited from that agreement as it included a clause whereby Staff “pension pots” would be revalued by CPI +1% annually. Between 2015 and 2017 and again between 2018 and 2021 two further agreements were concluded with staff whereby a total of 17% pensionable increases in salaries were awarded to staff. None of these benefits to staff are subject to a solvency test.

Pensioners, however, have been seriously disadvantaged by the Pensions Agreement, with an effective pension freeze for the past 11 years, and a solvency test which blocks the prospect of pension increases into the future. Those who negotiated and agreed the 2010 Agreement could never have envisaged the detrimental effect it would have on pensioners 11 years later.

Comments on €591million committed by ESB under 2010 Pensions Agreement

The Trustee Chair gave an account of how payment of this €591 was handled by the Pension Fund. He stated that the total actual value to the Fund was in excess of €800 million. At the end of 2019 there was an outstanding balance of €280 million owed to the Pension Fund.

An amount of €287 million was paid to the Fund in 2020, being the balance of €280 million plus €7 million in interest. However, €47 million of this money was paid into a separate Trust to be managed by existing Fund Trustees.

ESB is obliged to submit funding plans to the Pensions Regulator to address the Minimum Funding Standard (MFS). The last funding plan expired in 2018. ESBRSA has discovered that under the proposed new plan ESB has agreed with ESB Unions to raise the notional retirement age to 64.2 years, which enables the Scheme Actuary to reduce fund liabilities considerably to address an MFS deficit, currently running at in excess of €700 million. The Scheme rules were changed to accommodate this but have not yet received Government approval. However, the agreement with unions does not affect the actual retirement age and still enables staff to retire earlier than 64 years.

ESBRSA has also discovered that in order to fund this arrangement with Unions, ESB, in conjunction with Fund Trustees, have diverted the €47 million, which was due to be paid to the Pension Fund under the previous funding plan, to a separate trust to fund early retirement for staff. This enables ESB to avoid any further employer financial liability to address the MFS deficit under the new funding plan.

The purpose of the new €47 million Trust was not made clear by the Trustee Chair in his video presentation or in the Pension Scheme Annual report. He has stated that the new Trust is for the benefit of the Pension fund but has neglected to state that it is for the exclusive use of serving staff members only, to fund their early retirement.

The Trustee Chair has also neglected to state that the €47 million had been committed as part of the original €591 million to address the MFS deficit under the previous Funding Plan which expired on 31st December 2018. In ESBRSA’s opinion, The Trustees have not given clarity to this financial transaction, either in the Pension Scheme report or in the video presentation.

This is, in ESBRSA’s opinion, is unfair, inequitable and certainly not prudent accounting practice by ESB, supported by the Trustees, as it enables ESB to avoid any further employer financial liability to address the MFS deficit under the new funding plan. It is the duty of the Trustees to always act in the interests of All members of the Pension Scheme.

Question not Addressed in Presentation

The following question was submitted to the Trustees prior to the video presentation and was not addressed by the Trustee Chair

Are ESB going to address the serious underfunding of future service benefits (€188 million in 2017) for serving staff by increasing its own and staff contributions to the Pension Fund to match future benefits for serving staff over the remaining lifetime of the Fund?

This has the effect of increasing the Fund deficit by the above amounts, as liabilities for future staff benefits have no corresponding asset to fund them.

The benefits arise directly from the 2010 Pensions Agreement whereby serving staff “Pension Pots” are revalued by CPI + 1%, and from two further staff agreements between 2015 and 2017 and again between 2018 and 2021, were concluded with staff whereby a total of 17% pensionable increases in salaries were awarded to staff, without due consideration of the Pensions Fund’s ability to meet these liabilities in the future.

The Scheme Actuary from Mercers has identified a serious shortfall in funding of future staff benefits over the lifetime of the Fund. In two successive actuarial valuations of the Pension Fund in 2014 & 2017 he has identified shortfalls in funding of €86 & €188 million, respectively.

The only way to address these shortfalls is to increase company contributions to the Fund or share the burden between the company and staff. To date ESB has not taken any action to address this underfunding, which has implications for the solvency of the Fund and the potential for pension increases being awarded to pensioners, which are contingent on Fund solvency.

Unless ESB take immediate action to address this underfunding, it will increase over time until the problem will become almost unsurmountable.

Scheme Actuary Providing for all future years’ pension increases

According to the Trustee Chair, the Actuary must provide for all future years’ pension increases, otherwise no pension increases can be paid in the future. The Actuary is on record stating that the value of this provision is €730 million, included in Scheme liabilities. The Trustee Chair further stated that they intend to pay pension increases in the future.

ESBRSA would ask when they intend to do this, as many of our members have spent more than half of their retirement without any pension increase whatsoever. There have been no increases for more than 11 years, yet the Actuary has provided an average of 1.6% per annum in each of those years for pension increases.

The inclusion of €730 million in Scheme liabilities for pension increases that may or may not be paid increases the potential for a Fund deficit and therefore has a serious negative impact on the potential for pensioners ever getting an increase in their pensions in the future.

UPDATE 12th November, 2020

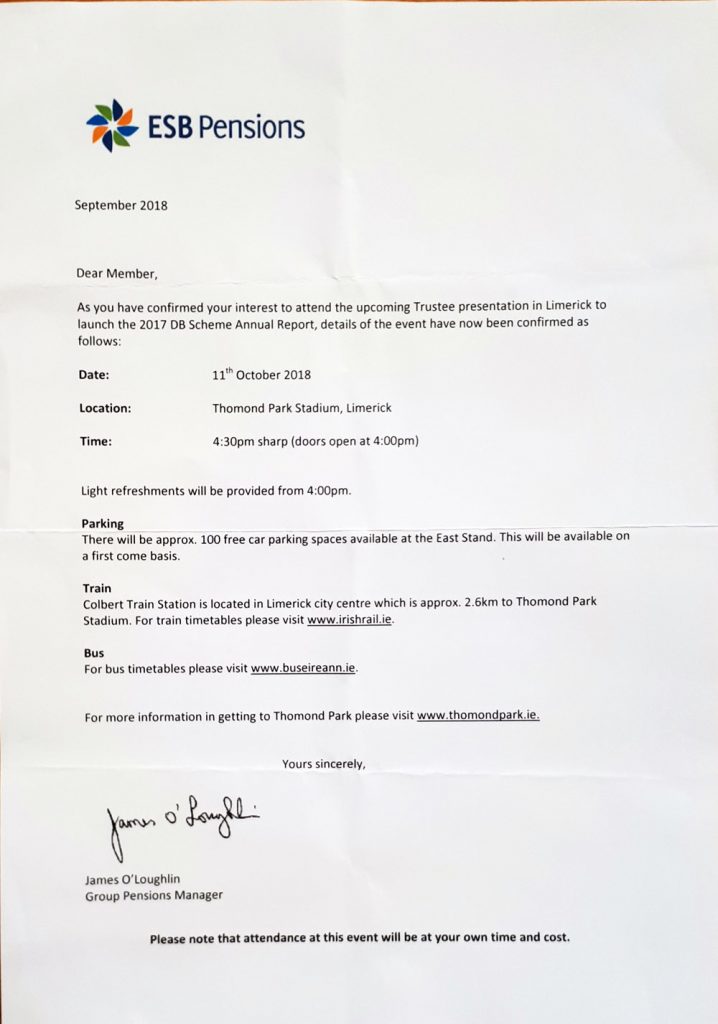

The questions listed below have been submitted for answer in the promised Video Presentation by the Pension Fund which was due in late October 2020 . We are advised by ESB Pensions Administration that the Video Link will be accessible through the ESB Staff Services web page. This link is now available at :

https://www.esbstaffservices.com/pensions/2019-db-annual-report-event/

Questions for Pensions Video Presentation November 2020

1. Why do the Trustees continue to support ESB’s decisions on the non-funding of Pension Fund deficits? ESB have abandoned the tried & tested traditional method of addressing Fund deficits i.e. increased contributions from ESB and contributing members.

2. Why did the Trustees agree to divert €47 million, intended for the ESB DB Pension Fund, to a separate Trust for the benefit of employees only, despite the fact that these funds were included in the 2012 Funding Plan. It is the duty of Trustees to act in the interests of All Scheme members. The details of this transaction are not properly explained in the Annual Report Summary.

3. Liam Quigley, Scheme Actuary, continues to provide in excess of €700 million for future year pension increases, despite the fact that no increases are being paid and even with this large provision included in Scheme liabilities the Fund is 98.5% solvent on an ongoing basis. This practice continues to block pension increases, which are dependent on 100 % solvency. For the purposes of calculating solvency in any given year, pension increases for that year only should be included. The Trustees continue to support this practice thus making it impossible for pension increases to be awarded for the medium term. The annual revaluation of pensions for serving staff pensions by CPI + 1% is not subject to a solvency test and neither is the awarding of pensionable salary increases for staff. All Scheme members should be treated equally.

4. Future service benefits for serving staff continue to be underfunded. These are mainly attributed to the underfunding of the annual revaluation of serving staff pensions by CPI+1% under CARE, and the awarding of pensionable salary increases to staff, without due consideration of the Fund’s ability to meet these liabilities in the future. Neither ESB or employees are making additional contributions to fund these benefits. This has the effect of increasing the Fund deficit by the amount of the underfunding thus creating an obstacle to the awarding of pension increases now or in the future. Trustees must ensure that all members or classes of member are treated equally. The serving staff and pensioners are, after all, the beneficial owners of the Fund

Financial Management Guidelines

For trustees of defined benefit pension scheme

Under Governance

The trustees should have engaged a scheme actuary and whatever other advisors they feel to be appropriate. In all cases, the trustees should be satisfied that they are the primary client of the advisor and that any relationship the advisor has with other parties does not affect on this primary relationship. The advisor should be required to confirm that there is no conflict of interest. The trustees must also consider carefully whether occasional rotation of advisers would be in the best interests of the members of the scheme

QUESTION:

The above text is a direct quotation from a Pension Authority publication, as indicated. Bearing that in mind and the fact that the current actuary (company) has been the appointed actuary to the DB Scheme for almost 50 years, what is the view of the Trustees on the subject of occasional rotation of advisors, and specifically the actuary (company) and is it the intention of the Trustees to secure rotation of the actuary in the near term. Rotation would mean issuing an enquiry for actuarial services for the DB Scheme to a list of such companies which list would not include the current actuary.

Questions for inclusion in the Oct video presentation

A.

Under the rules of the scheme, pension increases are discretionary and I will assume that the Committee has been given discretion on permitting early retirements.

1. Will discretionary early retirement by subject to the solvency test?

2. Will pensioners be refused a discretionary pension increase from the due date for an increase, if in the same year employees are being granted discretionary early retirement?

3. What will be the decision making process for the payment of discretionary benefits (pension increases and early retirements), having regard to the fact that a decision to pay a pension increase is made 9 to 21 months after the due date of effect for that increase, while a decision to permit early retirement could already have been made at any time following the due date of effect for a pension increase (1st Jan for the relevant year)?

Example:

Year’s Inflation Oct 2019 to Sept 2020,

Pension Increase Due Date: Jan 2021

Decision to Pay Increase Sept 2021

In 2021, will employee requests for early retirement be granted before it is known (Sept 2021) if a pension increase will be paid (from Jan 2021)?

B.

In the Trustee’s 2012 MFS proposal as approved by the Pensions Authority, Trustees undertook to collect from ESB the full €591m (2010 figure) by end 2018. Trustees failed to do so.

1. Why do you consider it is appropriate to divert a part of the €591m figure away from the pension scheme (in contravention of the terms of the 2010 Agreement) where it would have benefited all members as intended, and into a separate trust about which

pensioners have been told nothing and which your 2019 Summary Report mentions but gives no detail?

2. Is it the case that this new trust is to benefit only employees?

3. Is it the case that the diversion of funds is a de facto guarantee of early retirement even if pension increases are denied to pensioners given that in the Question and Answer document issued to members by James O’Loughlin on 12th Feb 2020 he stated “While the proposed solution does involve a rule change, it is not anticipated that the proposed solution will have any impact on the ability of members to retire from age 60”

C.

Concerning dates 1st Jan 2019 and 1st Jan 2020:

1. Will solvency test for both years be applied together or separately?

D.

There is nothing in the rules of the scheme (SI 18/2014) requiring the Committee to limit any pension increase to CPI should a larger increase be affordable. A collective agreement between ESB and the Unions cannot subvert or over-ride either primary or secondary legislation which is the exclusive preserve of the oireachtas.

Can you now agree that (1) the 2010 Agreement purported limit of CPI contravenes the rules of the Scheme as set out in legislation and (2) as such is void?

E.

The approved MFS Proposal 2012 put by the Trustees and agreed to by ESB violated the 2010 Pension Agreement in the following ways:

· The Proposal reversed the priority order for pension increases versus de-risking and

· De-risked far beyond anything provided for in the 2010 Agreement

Furthermore

· The diversion of funds this year to an-as-yet unestablished trust also violates the 2010 Agreement.

Can you now agree, whatever merits you as Trustees may see in those departures from the terms of the 2010 Agreement, that these departures are in fact breaches of the agreement as made?

QUESTIONS:

1. The Pension Fund Annual Report states that the fund has returned 8.2% per annum over the last 10 years, yet the Actuary deems it inappropriate to pay any pension increases to pensioners while making provision of over €700m in that period for those unpaid increases. How is it justified not to pay pension increases when the liability is already included in the Pension Fund and it is making returns of this order?

2. The Pension Fund Report states that no pension increase has been granted in 2018 or 2019 but that inflation was low both years at 0.9%. However the same report also states that CARE revaluation occurred at CPI + 1% and that serving staff pensions were increased by 1.9% in both 2018 & 2019. How is this position treating all members of the fund equally and fairly?

3. The pension levy is not reported on in the Annual Report. How much was collected from pensioners in 2019 for the Pension Levy and how much has been collected cumulatively to date for levy from pensioners? Why is this contribution by pensioners not reported on and shown in the funds accounts?

4. In the Financial Statements on Page 49, Item 6 shows investment income has increased by 6.1% in 2019 from 2018. Item 7 shows investment management expenses has increased by 21.9% in 2019 from 2018. How are such enormous increases in expenses justified given that 4 of the 10 Funds mentioned on the same page have decreased significantly? How are these very significant cost increases being managed & controlled by the Trustees of the Pension Fund?

I request specific answers to these questions and that they are not absorbed into general statements about the performance of the Fund

UPDATE 28th October, 2020

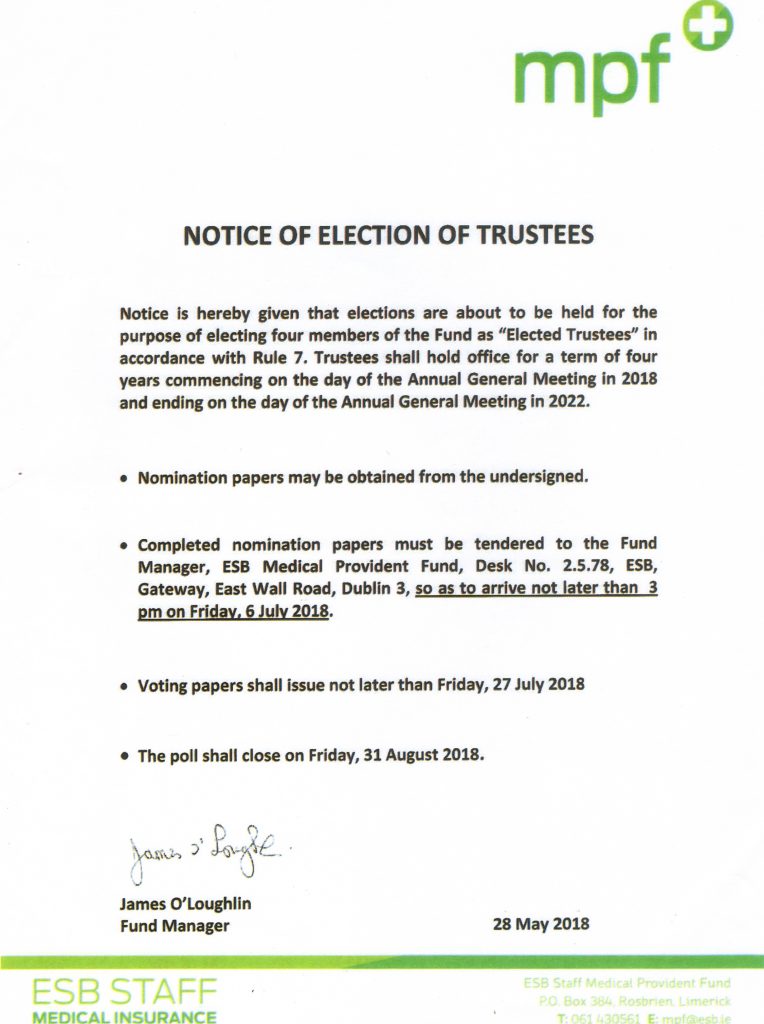

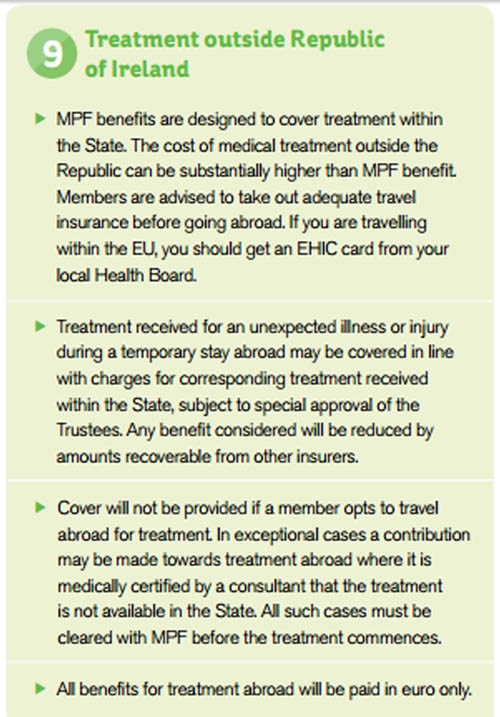

We have been requested by ESB Medical Provident Fund to display the notice below on the ESBRSA website

MPF Virtual AGM Notice & Agenda

Due to the Covid19 pandemic, the 2020 MPF AGM will be a virtual

event this year which we believe is in the best interests and safety of

all our members.

The Trustees, in accordance with Rule 9.3, have convened the Annual

General Meeting of the ESB Staff Medical Provident Fund for the

following date and time:

Date: Tuesday 10th November 2020

Time 5pm

Please email mpf@esb.ie (including your Policy Number in the

email) or contact the MPF office at 061 430561 to receive your log

in details to attend the AGM on line.

Agenda

1. Minutes of AGM held on 19th September 2019

2. Trustees Annual Report for year ended 31 December 2019

3. Audited Accounts for year ended 31 December 2019 *

4. Any Other Business

UPDATE 2nd October, 2020

ESOP Market Day Result

Link to ESOP Market Day Results 2020

The weighted average successful bid price was €0.95 per share

All forced sale shares were sold. Participants who offered shares for voluntary sale at minimum prices equal to or below the market price have been partially successful and sold approximately 26% of shares offered.

UPDATE 21st September, 2020

ESB RETIRED STAFF ASSOCIATION

NEWSLETTER AUGUST 2020

| CONTENTS |

| Section 1 ESB DB Pension Scheme – a State Occupational Pension Scheme |

| Section 2 ESB DB Pension Scheme Governance

2.1 Selecting Member Trustees by Election 2.2 Superannuation Committee Election 2.3 Governance Reform |

| Section 3 The Minimum Funding Standard

3.1 MFS Funding Proposal 2012 3.2 MFS Funding Proposal 2020 |

| Section 4 Consumer Price Index, Pensions & Pay |

| Section 5 Political Lobbying |

| Section 6 ESBRSA and ESB Forum |

| Section 7 Financial Loss due to loss of traditional indexation. |

| Section 8 ESBRSA & Covid 19 and Other News |

Section 1

ESB DB Pension Scheme – a State

Occupational Pension Scheme

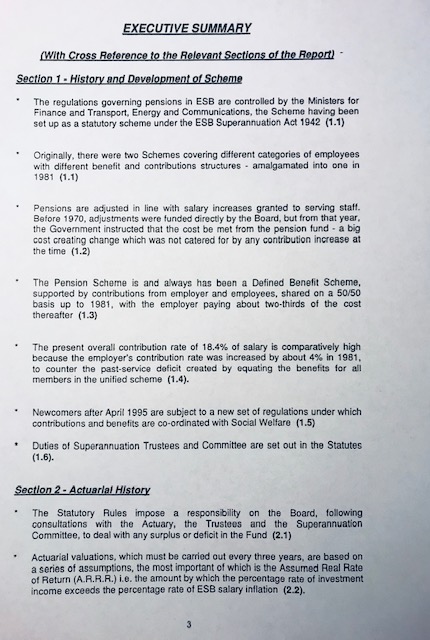

ESB DB Pension Scheme is a funded scheme which is regulated as if it were a purely private scheme, whereas it is a statutory state occupational pension scheme which has characteristics quite unlike any private pension scheme.

It is expressly provided for by statute; its rules cannot be changed without ministerial approval; its contribution rates require ministerial approval; and its annual report is only issued after ministerial approval; its members employed prior to April 1995 were required to pay the public service PRSI contribution.

As ESB employees, in common with public service employees, we were not permitted access to the state pension given that we already had a state sponsored occupational pension (employees first employed prior to April 6th 1995) indexed to salary increases, as a matter of public policy. This was not an ESB decision.

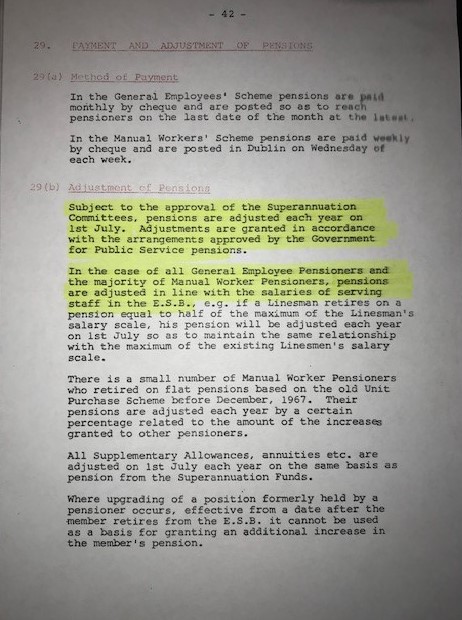

Government directed ESB to apply pension increases in line with salary increases in 1971/72. ESB General Employees Superannuation Fund Report for Year Ended 31st March 1972 under the heading “Pension Increases”, records that “The Minister for Transport and Power authorised ESB pensions to be related to the salary scales existing in the Electricity Supply Board on 1st Jan 1972”.

This public policy continued uninterrupted until 2010. The last national wage agreement pay round was a 3% increase to employees and pensioners on 1st Jan 2009.

In the Public Service, Government stopped non-mandatory traditional indexing at the time of the financial crisis but has re-established that indexing in recent times.

Our Scheme was entirely analogous to the Public Service except that it was funded.

| Government Circular DPE100-002-2017 29 Jan 2018

instructs a return to the non-statutory, pay-linked method of pension adjustment which prevailed until the onset of the financial emergency. |

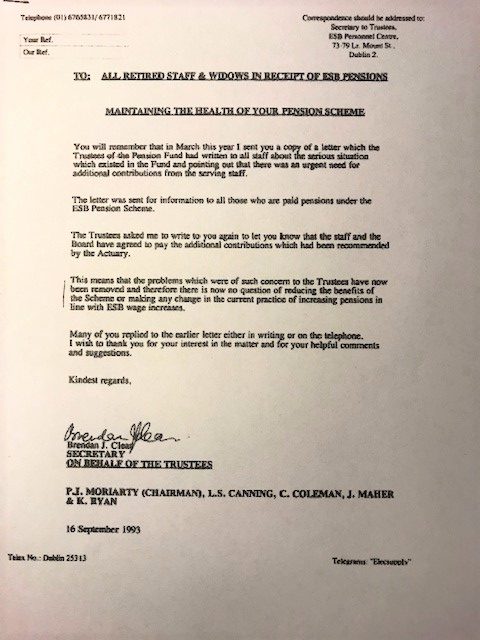

From 1981 onwards, contribution rates were established such as to take account of indexing in line with salary increases (confirmed in a 1996 written report “History and Development of ESB Superannuation Scheme” prepared by a trustee cum executive director of ESB at the request of ESB’s Chief Executive.

In the light of the above facts we continue to call for the re-instatement of traditional indexing as in the Public Service and in line with the terms and conditions of our contract of employment with ESB based as they were on public policy throughout our working lives and paid for by our pension contributions from 1981 onwards.

Section 2

ESB DB Pension Scheme Governance

2.1 Selecting Member Trustees by Election

Currently 2 members are elected as member trustees – one is drawn from the ranks of employee members and one from the ranks of pensioner members. In the recent election the employee member trustee vacancy on the Trustee Board was filled by Tony Walsh after a 15th July count. Other candidates were John Cronin, Martin Hand and Pat Hennessey. All 4 nominated candidates passed the pre-selection process. Congratulations to Tony Walsh on his election. His appointment is until next June 30th as the normal 5 yearly election will take place next May/June.

Under the Pension Act Regulations (SI376/1996) a valid candidate is a properly nominated candidate who accepts the nomination. Since the 2010 Pension Agreement, a pre-selection process has been used to disqualify some valid candidates from appearing on the ballot paper. This contradicts the relevant statutory instrument SI376/1996 which states that the regulations over-ride where necessary provisions made in the trust deed and rules of the scheme for selecting and appointing trustees. In the case of ESB DB Scheme the rules (as out in SI18/2014) are silent on the issue of selecting and appointing trustees.

SI376/1996 also requires an equal number of nominated trustees and member (elected) trustees be appointed, i.e. 4 nominated and 4 elected. This requirement has been ignored by ESB DB Scheme in Jan 2011 when Mr. Van Dessel and Mr. Kelly were nominated and appointed as trustees, and in the subsequent 2 elections. Twice our queries on this issue to ESB Pensions and Insurance Manager have been ignored.

We have written to the Pensions Authority about these apparent failures to comply with the Pension Act Regulations and await developments.

2.2 Superann. Committee Election 2020

The 10 person Superannuation Committee consists of 5 company nominees and 5 elected employee members who are elected by employee members only. By rule of the Scheme all 10 must be employee members of the Scheme. Pensioners are excluded. Following the election count date of 15th July 2020, our query to ESB Pensions Office seeking the names of those elected brought the reply “Following a nomination process the 5 outgoing elected candidates stood again and as there were no other candidates no election was required.”

ESB held this election process in full knowledge of our strenuous opposition to the continuing complete exclusion of pensioners from the election process including voting and Committee membership, even though employee members number less than 29% of the membership (2018 figure). RSA has brought this matter to the attention of the Pensions Authority which has recently replied that it has no power to direct ESB to change the composition of the Committee.

ESB has refused to move on revising the rules of the scheme, even though it has admitted that reform of the governance arrangements is required, on the pretext that Government has not yet legislated to transpose EU Directive IORP II into Irish legislation. The end-date for transposing the Directive was Jan 2019.

| At a Society of Actuaries In Ireland event on 12 June 2020, the Pensions Regulator, Brendan Kennedy, stated “The Department of Employment Affairs and Social Protection is working with the Office of Parliamentary Counsel on the IORP II transposition regulation. This work is high priority and has continued through the Covid-19 disruption, but I do not have an expected completion date.” |

In the ESB/RSA Forum Ms. Roma Burke, actuary and partner of Lane Clarke Peacock Ireland (a firm of financial, actuarial and business consultants) in a presentation on IORP II stated that the IORP II Directive had nothing to say about the composition of Governance bodies such as ESB Scheme’s Superannuation Committee. This makes ESB’s delay pending legislation appear as a pretext for avoiding change.

2.3 Governance Reform

Mr. James O’Loughlin, Manager Pensions and Insurance, is currently leading a governance review body. RSA made a presentation to that body last November. ESB has stated that the work of that body will not be completed until after Government transposes IORP II directive into Irish law. Even then, we have been given no indication as to how long completing its work will take nor a timescale as to how long it may be before governance reform is achieved.

Section 3

The Minimum Funding Standard

3.1 The Minimum Funding Standard 2012

The Trustees with the agreement of ESB made a MFS Funding Proposal in Dec 2011 co-signed by both parties. The Pensions Authority did not approve that proposal and the Trustees with the agreement of ESB modified their Proposal through “additional measures”. Among these measures were:

- The €591m special employer contribution committed to in the 2010 Pension Agreement should be paid to the Scheme in full by end 2018.

- Reversing the priority order for pension increases versus de-risking contrary to the terms of the 2010 Agreement

- Drastically de-risking the fund far beyond the level of de-risking set out in the 2010 Agreement, contrary to the terms of that Agreement.

ESB made no contribution to resolving the MFS deficit in 2012.

Only pensioners suffered loss – in this case their loss was of the meagre increases which the 2010 agreement should have delivered had surpluses not been diverted into de-risking far beyond the figure given in the 2010 Agreement. At the same time employees’ pensions grew unconditionally at CPI+1% leading to employees who retired in 2018 retiring with pensions more than 8% higher than if they had retired with the same service prior to CARE commencement.

3.2 The MFS Proposal 2020

You will recall that last February James O’Loughlin, ESB Pensions and Insurance Manager, wrote to all members of the Scheme advising of a recommendation from the Pensions Implementation Forum (consisting of representatives of Trustees, ESB, Superannuation Committee and Group of Unions) to vary the rules of the Scheme to make early retirements between age 60 and State Retirement Age subject to the discretion of the Superannuation Committee as a way to eliminate the MFS deficit.

ESB Board approved this Proposal and has requested Ministerial approval for a necessary rule change and the MFS Proposal itself. On 25th August, ESB Pensions Office has confirmed to us that the necessary approval for the rule change remains under consideration with no approval granted yet.

Again, ESB is not contributing to the elimination of the MFS deficit.

The 2012 MFS Funding Proposal approved by the Pension Authority was in part based on the payment by ESB of the special €591 million contribution (2010 value) by end 2018. It is now past mid-2020 and a €287 million (current value) balance is still outstanding. Recently ESB has proposed in the Implementation Forum to pay €240 million to the Scheme and to divert €47 million to another legal entity, another Trust, not yet established, to the benefit only of employee members of the our DB Scheme. RSA has written (15th July) to the Trustees requesting their reassurance that they will not accept that proposal which would be to the detriment of all members of the Scheme, pensioners, deferred members and employees. As yet (27st August), no reply has been received from the Trustees. As ESB’s proposal violates the Funding Proposal 2012 approved by the Pension Authority, we have written (7th August) to the Authority about this and await its reply.

Section 4

Consumer Price Index, Pensions & Pay

From 1st Jan 2010 until end Dec 2019 CPI has grown by 7.6%. In that period your pension has grown by 0.2% (at 1st Jan 2018) without accounting for the government levy and now by minus 1% after the government levy. The purchasing power of your pension has fallen accordingly.

Over the same period employee members have had 5 pay rounds commencing 20th April 2015. To the end of 2019

- their pay rate has grown by 12.9%

- the cash value of these 5 increases compound one on top of the next to give a total cash sum equal to 31% of their March 2015 annual salary.

By the end of this year, 2020, employee members will have had 6 pay rounds. To the end of 2020

- their pay rate will have grown by 15.7%

- the cash value of these 6 increases compound one on top of the next to give a total cash sum equal to 44% of their March 2015 annual salary

That 6th pay round covers a 15 months period to end 2021 by which time the cash value of those 6 pay rounds will be equal to 60% of their annual salary at March 2015.

Section 5

Political Lobbying.

Our Chairman Tony Collins and Vice Chairman Tom O’Brien had a useful meeting with a senior politician concerning our pension scheme and the treatment of pensioners by ESB/ESB Pension Scheme. We will continue to lobby. We also urge you to raise our treatment as pensioners with your elected representatives.

Section 6

ESB and ESBRSA Forum

ESB provided the Forum as a place where ESBRSA and ESB management could meet and give RSA an opportunity to articulate the issues and concerns of pensioners to management. ESB provided 2 permanent senior representatives who informed us that they were there to listen and would convey our concerns and issues to their senior management. They described themselves as “messengers and not decision makers”. Others attended by invitation, e.g. Manager Pensions and Insurance, Executive Director Enterprise Services, the Superannuation Committee (once). The Trustees absolutely refused to attend.

Both in the Forum and in direct correspondence to ESB Chairman, Chief Executive and Board members, RSA has explained the issues and concerns of pensioners to the point of exhaustion of both the subject and our ability to explain it.

Pensioners have had no tangible benefit from RSA’s engagement with ESB and have suffered an outcome far worse than anything ever envisaged in the 2010 Pension Agreement.

It has never been the intention of RSA to walk away from the Forum but any committee/ forum/ body established for a limited purpose can only decay into irrelevance once that purpose has been served.

If the Forum is not to fall apart it needs renewal which must provide equality of esteem for all members of the scheme irrespective of constituency; should be consistent with the facts that (1) the scheme has been closed to new entrants since 1st Jan 2011; (2) recognise that active members are a diminishing minority (28.6% of membership at end of 2018); (3) that the scheme will eventually have zero active members; and must end the preferential treatment of active members as represented by the Unions, to be achieved by extending to pensioners and their representatives the same rights as employees and their Unions in all matters connected with the Scheme.

The Forum’s original mandate was set out by ESB Senior Management and we have called on them to expand its scope and purpose but ESB has so far refused to depart from the Forum’s very limited mandate as a place for consultation (their word). In all matters pertaining to the pension scheme ESB will engage, consult and negotiate with the trade unions on behalf of employee members including deciding on outcomes but will not consult with RSA before decisions are made. The most recent example is the MFS Proposal requiring a rule change. “Consultation” after the fact/decision is not consultation. At best, it is briefing.

In the light of experience where pensioners have not benefited in any tangible way from our participation in the forum, we have stepped back from it for now. No meetings have taken place this year and not just because of Covid19. It remains available should we chose to request that it meet.

| After over 4 years in the Forum we consider the purpose of our participation in it to have been met in full with no tangible benefit to retired members.

Further participation in the Forum under the current terms of engagement appears to be pointless at this time. |

Section 7

Financial Loss due to non-application of traditional indexation.

| Lost Cash Value per Calendar Year for a Pensioner on a Pension of €26,000 / year due to refusal of traditional indexation in line with salary increases from 20/04/2015 | |

| 2015 | € 363 |

| 2016 | € 1,067 |

| 2017 | € 1,562 |

| 2018 | € 2,156 |

| 2019 | € 2,808 |

| 2020 | € 3,528 |

| 2021 | € 4,078 |

| Total Loss to end 2021 | € 15,561 |

On a Pension of €26,000 the total amount lost over the periods:

2015-2019 = € 7,955 = 30.6% of 2015 pension

2015-2020 = €11,483 = 44.2% of 2015 pension

2015-2021 = €15,561 = 59.9% of 2015 pension.

Section 8

ESBRSA & Covid19

Our most recent monthly committee (GPC) meeting was on 5th March last. Our AGM, due toward end June last, is postponed until a date and place to be determined when public health measures for covid19 permit. Just now, such measures do not even permit our monthly GPC meetings.

https://www.citizensinformation.ie/en/health/covid19/public_health_measures_for_covid19.html

Other news:

One pensioner has informed us he made a formal complaint to the Pensions Ombudsman concerning his financial loss as a result of the 2010 Pension Agreement. The Ombudsman’s Office engaged ESB in a mediation process which offered no resolution. The pensioner accepted that the Ombudsman proceed further by way of a more formal investigation and adjudication procedure which is expected to take many months.

Our thoughts and sympathy are with all who have suffered illness or bereavement from Covid19 or other cause.

Keep well and stay safe.

RSA Executive.

28th August 2020

UPDATE 10th September, 2020

We have been requested by ESB Medical Provident Fund to put the following notice on the ESBRSA Website.

A message to our customers

MPF Covid-19 Update for members

10th September 2020

Pre-Admission Covid Test fees

MPF are pleased to announce that agreement has been reached with all private Hospitals who have been charging a fee for pre-admission Covid Tests to pay this expense directly on your behalf.

Our members will not now be required to pay this expense as the Hospitals will charge MPF directly with effect from today.

If you have already paid such a fee since July 1st 2020, please forward your itemised receipt accompanied by a Benefit Claim form to the MPF office to claim a full reimbursement of same.

UPDATE 7th September, 2020

The link below enables members to access the ESBRSA August 2020 Newsletter.

UPDATE 4th September, 2020

We have been requested by ESB Employee Assistance Program to put the following notice on the ESBRSA Website.

ESB Occupational Health wish to advise you of a change to this year’s flu vaccination programme.

In light of COVID-19 pandemic the HSE have announced that they are providing free flu vaccinations to all individuals who fall into the at-risk or recommended group which include individuals aged 65 and over.

If you are in this category you can receive your flu vaccine directly through your local GP or pharmacy free of charge by declaring that you fall into the at-risk group. Therefore, for this year’s flu vaccination programme we ask you not to request a voucher through ESB.

Vaccinations will be available from 1st October 2020.

The full list of the ‘at risk or recommended group’ are available on the HSE website HERE

UPDATE 12th August, 2020

The details published on the ESB Staff Services website now show that Tony Walsh was the candidate elected to the Trustee Board of the Defined Benefit Pension Scheme in the recent election.

UPDATE 2nd July, 2020

Reminder

We would remind all retired staff that the 2020 Trustee Election ballot papers must be returned by the closing deadline of 3pm on Tuesday 14th July 2020.

We urge all pensioners to use their vote.

The candidates are, in alphabetical order :

John Cronin

Martin Hand

Pat Hennessy

Tony Walsh

UPDATE 30th June, 2020

We have been requested to put the information below on the ESBRSA Website by ESB Insurance.

ESB Staff Insurance Scheme Competition

Competition Winners Announced

COMPETITION RESULTS:

Question: Who is our new broker?

Answer: MARSH

AND THE WINNERS ARE …………………………

Angela Lyons, Retired

Frank McDonagh, Retired

Martina O’Brien, Networks, Fermoy

Aisling Delaney, Gateway

Aoife Trihy, Trading

Frank Byrne, Swift Square

Emma Hogan, Networks, Leopardstown

Richard Sheehan, Engineering & Major Projects

Anne-Marie Casey, Customer Solutions, Electric Ireland

Congrats to all who received a voucher each for €50. We appreciate your continued support.

UPDATE 22nd May, 2020

We have been requested to put the information below on the ESBRSA Website by ESB Insurance.

ESB Staff Insurance Scheme

Motor Insurance COVID-19 Rebate from Allianz

We hope you are keeping save and well during these difficult times. We’re pleased to let you know that you can expect to receive a rebate of €30 in the form of a refund cheque shortly. This refund is due to an expected fall in the number of claims as a result of fewer cars on our roads during the COVID-19 restrictions.

Cheque refunds will start to issue at the end of May. The issuing of these cheques is a significant undertaking for Allianz, but you should receive your cheque by the end of June.

We have 4 One4All Vouchers for €50 each. To be in with a chance to win one of these,simply email us : your name, your current home, motor or travel insurance policy number

(just one policy number will do for your entry) and the name of your new broker to our

email address: esbstaffinsurance@jlt.ie . You must put “COMPETITION” in the subject title.

Alternatively you can call us on 01702669 to phone in your entry. Closing date is 31st May.

Good luck to all

UPDATE 14th May, 2020

We have been requested to put the information below on the ESBRSA Website by ESB Insurance. Another update is expected soon regarding a rebate from Allianz.

COVID-19 Update From ESB Staff Insurance Scheme

COVID-19 Update From Allianz, The Insurer of ESB Staff Insurance Scheme

IMPORTANT CONTACT DETAILS

Allianz Claims/Emergency 1890779999

(including Home Emergency Assistance/Roadside Assistance/Windscreens)

ESB Staff Insurance Scheme Team: 01-7026699 Option 5

ESB email contact: esbstaffinsurance@jlt.ie

Website: www.esbstaffinsurancescheme.ie

We recognise that these are uncertain times for everyone and we want to reassure you that our Claims Lines & 24/7 Emergency Assistance services continue to be maintained by our dedicated team of over 600 people here in Ireland (refer contact details below).

We’ve been working hard on additional changes to how we support all ESB Home & Motor customers as fairly as we can in these uncertain times. We will be doing more too, and will share these changes with you as soon as possible

Today we want to share/remind you of some of the changes and supports that Allianz Ireland has put in place for ESB Home & Motor customers so that we can play our part during this national and international emergency.

What we are doing for ESB Home & Motor Customers:

We are adding/reminding you about extra features to our motor and home insurance products to reassure all personal customers of our commitment:

1. Your Allianz policy covers remain fully active throughout this crisis – except where customers request otherwise and we agree to a reduction or suspension of cover;

2. Auto-renew: Your policy is renewed automatically, unless you instruct us otherwise. We won’t cancel your policy for non-payment unless we speak/communicate with you first.

3. Pay by interest-free salary deductions: Remember, if you are on the ESB payroll, you can opt to pay your premium by interest free instalments from your ESB salary- Simply call our team on 017026699 Option 5 before renewal and we’ll do the rest

4. Temporary additional drivers: ESB customers can add temporary additional drivers for up to 90 days (previously 42) at no additional charge;

5. Our Home Emergency Assistance and Roadside Assistance services continue to be available 24/7; Ring 1890779999

6. Remote working: For customers who have commenced working from home or remotely, enhanced and increased home office equipment cover is now provided under ESB household policies. Work duties are restricted to Clerical/Admin activities; see the FAQs below for more information;

7. Owner Occupied Home / Family Homes: The period of time after which we may exclude certain covers under your home insurance, due to the property being unoccupied, is 60 days. This means that if you are unable to check on your home, full cover will apply for up to 60 days, at which point cover will be reduced as per our standard policy terms and conditions if the property remains unoccupied. This takes effect from 27th March onwards.

8. Holiday Homes: Similarly, if you have a Holiday Home the requirement for the property to be checked once every 30 days will be extended to up to 60 days during this time.

9. NCT tests: We understand that customers are unable to undertake NCT tests due to the Government restrictions at this time; and so we would like to reassure our existing and new customers that car insurance cover will continue to be provided and maintained during this time.

How we are supporting the community and those on the frontline:

In addition, we are also supporting our customers who are directly involved in fighting COVID-19. These extra measures include:

Car Cover for Volunteers: Car insurance use is extended beyond normal personal use for our customers helping within their community for voluntary purposes; e.g. to transport medicines or groceries to those in need, or to take those that may be ill or vulnerable to hospital or testing facilities;

Frontline Workers using their own car for work purposes: you are also fully covered per their policy terms when borrowing another car in an emergency or to get to work and breakdown assistance will automatically be extended when they need it during the crisis;

We’ve been operating in Ireland for over 100 years and throughout that time our focus has always been on sustainable, equitable and actionable measures to support our customers, our employees and the wider economy. We’d like to thank all our customers for their support over the years and at this time.

Working From Home FAQ’s:

I am working from home. Am I covered?

Yes and there is no need to contact us to let us know you are working from home as the following measures are automatically in place to protect you:

Is equipment covered?

Your policy provides cover for Business equipment owned by you (or your employer for which you are responsible), up to a maximum of €4,000 with a single article limit of €1,500.

Are other family members covered to work from home?

The existing provisions cater for you working from home in connection with the ESB or its subsidiaries and have been extended under the current COVID-19 crisis to include cover to non-ESB employees permanently residing in your home

Can I hold an ESB meeting in my home?

No, your policy does not extend to cover third party liability i.e. you are not covered to hold meetings with anyone (whether ESB employees or otherwise) in your home.

I work remotely from a Shomera on my property. Am I covered?

If any policyholder has a Shomera, this must be notified to us to ensure cover is extended. In addition, the building sum insured must be adequate to include same.

UPDATE 26th April, 2020

A photo of the 2007 Osprey and Clanwilliam House Long Service Awards Group has been added to the Gallery page

UPDATE 24th April, 2020

Dear Members,

May I refer to the previous update on the website (Update of 20th April 2020)

The letter to ESB Chief Executive objected in the strongest possible way to Superannuation Committee elections being held under existing Scheme rules. The Superannuation Committee is representative of serving staff only, who comprise only 29% of total Scheme membership.

This letter to the Pensions Regulator is putting those objections on record and asking for the Regulator’s assistance in this matter.

——————————————————————————————-

Mr. Brendan Kennedy,

Pensions Regulator,

Pension Authority,

Verschoyle House,

28-30 Mount Street Lower,

Dublin DO2KX27

12th April 2020

Dear Sir,

It has come to the attention of ESB Retired Staff Association (ESBRSA) that ESB are in the process of seeking nominations for Superannuation Committee elections to be held in May/June 2020. This Committee approve retirement benefits for serving staff and ongoing benefits for pensioners. The Committee is comprised of 10 members, 5 nominees from the serving employees and 5 nominees from ESB Management.

These elections are being held despite strenuous objections from ESBRSA over the last 4 years or so that this Committee should not be re-constituted under existing Pension Scheme rules, given the changed demographics of Pension Scheme membership very much in favour of pensioners. Existing Scheme rules provide for nominees from serving employees only to fill committee positions. ESB serving staff/contributing scheme members, comprise only 29% of total scheme members and pensioners/deferred pensioners comprise 71% of the total membership.

ESBRSA & ESB have been participating in a Joint discussion Forum for the last 5 years or so to exchange views on topics of mutual interest. During that period, ESBRSA have put a lot of time & energy into discussing the changing demographics of ESB DB Pension Scheme membership, and the lack of pensioner representation on various bodies responsible for Pension Scheme Governance.

In the course of those Forum discussions ESB have acknowledged that the current Governance structures in the Scheme are not fit for purpose yet they are resisting any rule changes until the forthcoming legislation regarding the EU directive on IORPS11 is clarified. ESBRSA have stated that the process of changing Pension Scheme rules to facilitate representation for pensioners is separate and distinct from the provisions of IORPS11, which deals specifically with Trustee responsibilities and is not in any way linked to composition of Trustee Boards.

ESB’s intransigence in this matter is quite frustrating and this current exercise of holding Superannuation Committee elections under existing Scheme rules is totally undemocratic i.e excluding 71% of total Scheme membership i.e pensioners, from participating in the nomination and voting process for a body that ultimately makes decisions affecting all Scheme members.

There is still much to be done in order to achieve a fair and representative governance structure for ESB DB Pension Scheme.

1. The Superannuation Committee will be elected for a further 4-year term and continue to exclude representation from pensioners. This Committee continues to make decisions on benefits i.e. pension increases, and retirement benefits for serving staff

2. The Pensions Implementation Forum, which also does not include any pensioner representatives, makes decisions on pension increases and very recently was very much to the forefront in negotiating revised pension arrangements to facilitate proposals on the Minimum Funding Standard being agreed with ESB group of unions, representing serving staff only. Pensioners were excluded from this process.

This totally unbalanced governance structure that exists in ESB DB Scheme is undemocratic and discriminatory towards pensioners and ESB’s failure to address this imbalance is a clear indictment of ESB attitude to pensioners in this and other pension related matters.

I would appreciate your assistance in this matter and your advice as to what actions you could take regarding the above.

Yours sincerely

Tony Collins

Chairman, National Executive

ESB Retired Staff Associat

UPDATE (2) 23rd April, 2020

We have been requested by ESB MPF to put the information below on the ESBRSA website. It is important to note that ESBRSA has had no reply from MPF other than that below to our letter dated 9th April which was put on our website on the Update of 17th April.

For your information a comparison of the rebates that the major Health Insurance companies are making is as follows:

MPF Covid-19 Update for members 23 April 2020

In light of the Covid-19 crisis and the potential impact on private health insurance cover (primarily

delaying certain private procedures) the Trustees of ESB Medical Provident Fund have agreed the

following rebate for members for the period April to June inclusive 2020:

MPF Premium Plan member

Adult Over 25 years of age €90 (€30 per month)

Adult 24-25 Age €75 (€25 per month)

Adult 23-24 Age €60 (€20 per month)

Adult 22-23 Age €60 (€20 per month)

Adult 21-22 Age €45 (€15 per month)

MPF Premium Plus Plan member

Adult Over 25 years of age €150 (€50 per month)

Adult 24-25 Age €135 (€45 per month)

Adult 23-24 Age €120 (€40 per month)

Adult 22-23 Age €105 (€35 per month)

Adult21-22 Age €90 (€30 per month)

The rebates will be paid over 3 months to subscribers in May, June and July 2020 and will be based on membership on the last day of the month for which the rebate is being processed.

The Trustees will further review the situation at the end of this 3-month period.

UPDATE 23rd April, 2020

The link below will bring you to a letter from ESB in reply to ESBRSA’s complaint to the Chief Executive (see UPDATE dated 20th April) that pensioners who make up 71% of the DB Scheme are to be denied a vote and representation on the membership of the Superannuation Committee.

UPDATE 20th April, 2020

Dear Members,

RSA have been participating in a joint ESB & RSA discussion Forum for the past 5 years or so. One of the main topics for discussion has been the rapidly changing demographics of Pension Scheme membership in favour of pensioners and pro rata representation for pensioners on the Trustee Board and on the Superannuation Committee, the latter having no pensioner representation at all. The recent decision by Group Pensions to invite nominations for the Committee elections under existing Scheme rules, has angered and frustrated RSA participants in the Joint Forum, given the amount of time and energy devoted to this Forum over the past 5 years. This letter to ESB Chief Executive objects in the strongest possible way to these elections being held. The Superannuation Committee is representative of serving staff only, who comprise only 29% of total Scheme membership.

ESB RETIRED STAFF ASSOCIATION

ESTABLISHED 1974

NATIONAL EXECUTIVE COMMITTEE

T. COLLINS, JIM DEVLIN, M.KELLY. A. McCAFFERTY,

PETER LYNCH, TOM O’BRIEN

Mr. Pat O’Doherty

ESB Chief Executive,

Two Gateway,

East Wall Road,

Dublin 3.

D03 A995

10th April 2020

Dear Pat,

I write to you regarding Governance of ESB Defined Benefit Pension Scheme.

I understand that ESB Pensions have recently issued a request to serving staff for nominations for Superannuation Committee elections despite strenuous objections from RSA over the last 4 years or so that this Committee should not be re-constituted under existing Scheme rules, given the changed demographics of Pension Scheme membership very much in favour of pensioners.

In these challenging and worrying times when the focus of the country and the world is on the current COVID-19 crisis, the saying “never waste a good recession” comes to mind and ESB using a recessionary period to introduce new measures i.e. 2010 Pensions Agreement following the 2008 market crash. This move to elect a new Superannuation Committee comes during one of the greatest recessions that this country and most of the world is experiencing.

Under the auspices of the Joint ESB & RSA Forum, RSA have, over the last 5 years or so, put a lot of time & energy into discussing the changing demographics of ESB DB Pension Scheme membership, currently comprised of serving staff (29%) and pensioners/deferred pensioners (71%).

In the course of those Forum discussions during that 5-year period ESB have acknowledged that the current Governance structures in the Scheme are not fit for purpose. Roma Burke (LCP), has provided independent advice on this topic and has agreed that Governance Structures are in need of review based on the changing demographics very much in favour of pensioner members.

It appears that RSA efforts in that 5-year period have been very much in vain, despite the evidence of numbers, so glaringly obvious, that the Superannuation Committee, is totally unrepresentative of all Scheme members, ESB have decided to hold elections for a Committee that will hold office for a further 4 years. This decision appears to based solely on the basis that the EU directive on IORPS11 has not yet been incorporated into Irish law and a company decision to make Governance changes once only. This decision also links that directive to the process of changing Scheme rules in order to facilitate changes to the composition of the Superannuation Committee.

Roma Burke, independent consultant (LCP) has clearly stated during a number of presentations to the Forum that the IORPS11 directive does not contain any proposals on the composition of Trustee Boards, which in ESB’s case includes the Superannuation Committee. RSA have also stated that the process of changing Pension Scheme rules to facilitate representation for pensioners is separate and distinct from the provisions of IORPS1, which deals specifically with Trustee responsibilities and is not in any way linked to composition of Trustee Boards.

ESB’s intransigence in this matter is quite obvious, a clear statement that Governance changes will be visited only once. It is also quite clear that there is reluctance on ESB’s part to raise this issue with ESBGoU who have a vested interest in the continuation of the status quo with regard to Committee elections. It was also quite evident recently, that every effort was made to expedite Scheme rule changes to facilitate this MFS process, yet rule changes to facilitate Pensioner representation on Superannuation Committee are being heavily resisted by ESB.

This current exercise of holding Superannuation Committee elections under existing Scheme rules is totally undemocratic i.e excluding 71% of total Scheme membership i.e pensioners, from participating in the nomination and voting process for a body that ultimately makes decisions affecting all Scheme members.

There is still much to be done in order to achieve a fair and representative governance structure for ESB DB Pension Scheme.

1. The Superannuation Committee will continue for a further 4 years to exclude representation from pensioners. This Committee continues to make decisions on benefits i.e. pension increases, and retirement benefits for serving staff

2. The Pensions Implementation Forum, which also does not include any pensioner representatives, makes decisions on pension increases and very recently was very much to the forefront in negotiating revised pension arrangements to facilitate proposals on the Minimum Funding Standard being agreed with ESB group of unions, representing serving staff only.

This totally unbalanced governance structure that exists in ESB DB Scheme is undemocratic and discriminatory towards pensioners and ESB’s failure to address this imbalance is a clear indictment of ESB attitude to pensioners in this and other pension related matters.

The failure of ESB to address this and other issues will be raised in due course with the Pensions Authority.

Yours sincerely

Tony Collins

Chairman, National Executive

ESB Retired Staff Association

Copy by email to : James O’Loughlin, Group Pensions & Insurance Manager

UPDATE 17 April, 2020

Dear Members,

You may have heard discussions on the airwaves regarding private medical insurance and services no longer available to subscribers. Private hospitals have been re-designated as public hospitals for the duration of the COVID-19 crisis. This letter requests financial compensation for MPF subscribers using the same criteria as other insurers such as VHI, Laya & Irish Life. These insurers have arrived at a compensation package for their members based on the level of cover that each policy holder has. We would expect that MPF will follow along these lines and RSA will follow up to ensure that this is done.

ESB RETIRED STAFF ASSOCIATION

ESTABLISHED 1974

NATIONAL EXECUTIVE COMMITTEE

T. COLLINS, JIM DEVLIN, M.KELLY, A. McCAFFERTY,

PETER LYNCH, TOM O’BRIEN

Mr. James O’Loughlin

Group Pensions & Insurance Manager,

Two Gateway,

East Wall Road,

Dublin 3.

D03 A995

9th April 2020

Dear James,

I write to you on behalf of RSA members who are currently subscribing to ESB Medical Provident Fund. I also refer to a recent conversation that RSA Vice-Chair, Tom O’Brien had with John Conneelly, Team Leader in Rosbrien.

The current COVID-19 crisis has, by necessity, changed the whole dynamic with regard to private medical insurance. Private hospitals have been, by agreement with the HSE, re-designated as public hospitals and as such will not available for private medical consultations and procedures for as long as this crisis continues.

There has been a lot of discussion on the airwaves recently regarding those people who currently have private medical insurance and due to the current COVID-19 crisis, cannot avail of the normal range of services that would be covered by their insurance policies.

I understand that some of the large medical insurers such as VHI, LAYA and Irish Life are currently in discussions with Government on the whole subject of private medical insurance and services no longer available to their subscribers with a view to agreeing financial compensation for members who find themselves in this situation.

RSA believe that MPF subscribers, who are in the same situation, i.e. paying for services that are no longer available to them, should also be entitled to whatever financial compensation is agreed by the other insurers with Government.

RSA will be watching, with interest, to see what the outcome of these discussions will be.

I would expect that the above issues would be high on the agenda of any discussions/meetings with MPF Trustees and would appreciate if you would advise the MPF official position at your earliest convenience.

I look forward to hearing from regarding the above.

Yours sincerely Tony Collins

Chairman, National Executive, ESB Retired Staff Association

UPDATE 2nd April, 2020

We have been requested by ESB Insurance to put the information below regarding Emergency Home Assistance below on our website for members information in light of the Covid-19 difficulties.

Emergency Home Assistance

COVID-19 – ESB Staff Insurance Scheme – Here to help in an Emergency

Rollup Image

Page Content

|

We hope you are all safe and well during this time. We want to respond to your emergency as quickly as possible. As you can imagine, service levels may be impacted due to availability of tradesmen, but rest assured, we will do our utmost to assist you. |

WHAT IS EMERGENCY HOME ASSISTANCE?

An emergency is an unexpected event which damages or potentially could cause damage to your home. It usually calls for immediate action to prevent further loss or damage and to make your home safe and secure. To support you, your ESB home insurance policy now offers a new and improved service, Emergency Home Assistance. So whether it’s a burst pipe or you lose your house keys ESB home insurance customers can now call 1800 779999 day or night. This service is a standard benefit on all ESB home insurance policies.

If you do not have home insurance and would like to talk to someone about setting up a policy call 01 702 6699 (option 5) now or email us on be esbstaffinsurance@jlt.ie

KEY BENEFITS OF EMERGENCY HOME ASSISTANCE

1. Covers the cost of the call out, labour & materials (up to €300 per incident, four times per year)*

2. Aim to have a certified tradesperson with you in 90 minutes

3. Available 24/7/365

4. No excess (this is not a claim so you don’t pay an excess)

5. No affect on your No Claims Bonus

*Doesn’t cover wear and tear or loss or liability caused by any act carried out to provide the emergency service

HOW WE CAN HELP YOU

The main priority is that you know you can call us if you find yourself in a home emergency, like, but not limited to, the following:

· Water Leak

Water moves fast but so do we! We cover emergencies inside your home such as burst pipes, blocked drains, damaged water tanks or leaking radiators

· Locked out

We’ll get a locksmith to your home to cover theft, loss and damage to your lock and keys so you can get back in safely

· Broken windows

We cover broken glass in outside windows or doors which makes your home unsafe and vulnerable

· Heating or electricity breakdown

If your heating system or electricity supply breaks down unexpectedly we can assist to restore it

AFTER A HOME EMERGENCY

We understand that immediately following an emergency can be difficult so that’s why we provide the following services to support and help you through it:

· Overnight accommodation with transport for up to 4 people**

· Transport and storage of your furniture for up to 7 days (up to 50km)***

· Pass on urgent messages to your family at home or abroad

**Subject to a maximum of €50 per person, up to a total of €200 for any one incident. Only applicable if we deem your home uninhabitable.

*** Subject to a maximum of €200 for any one incident. Only applicable if contents need to be removed for security reasons. ESB home insurance policies are underwritten by Allianz.

Visit us on www.esbstaffinsurancescheme.ie

UPDATE 23rd March, 2020

Some photos of TOD staff in 1967 have been added to the Gallery page. With thanks to Michael Hughes.

UPDATE 19th March, 2020

We have been requested by ESB Insurance to put the information below on our website for members information in light of the Covid-19 difficulties.

Dear Customer,

During this extraordinary time I hope that you, your loved ones and your colleagues are well. There is no doubt that this situation is impacting many of us in our daily work and life

With a continuously evolving situation like COVID-19 impacting our country and the global community, we all face a very challenging time. I want to assure you that our top priority is to protect the health and safety of our employees and our customers and we are putting every effort into ensuring we can continue to deliver the customer support and service you need during this time.

We have strong business continuity plans in place and we will continue to monitor and plan ahead for all eventualities in order to protect you and our employees during this unprecedented time, so you can be assured of receiving the highest level of service with minimal disruption from ESB Staff Insurance Scheme (see Useful Information below).

Thank you for your continued trust and support. If you have any questions or concerns please do not hesitate to contact me or a member of the team on 017026699 Option 5 or email: esbstaffinsurance@jlt.ie

Andrea Byrne

Manager

ESB Staff Insurance Scheme

Phone: 0879483990

USEFUL INFORMATION

Daily Activities

We are endeavouring to operate remotely and are adequately equipped to do so but some activities can only be performed on site. We are limiting the number of people in the office.

Counter Service Cancelled

Our Counter service is cancelled until further notice. Please do not call into our office. Payments can be made by calling us on 017026699 Option 5, Option 1.

Telephone Lines are Open

Our telephone lines and email service are open and staffed. However there are limitations on phone lines and I would ask that you be patient if you do not get an immediate answer. We are aiming to call back within 20/30mins. If you are expecting a call back, it will be from a blocked number so please answer (as the majority of the team are working remotely).

Email – For a quick response

For an efficient response to queries, please click on the link to use our email service: esbstaffinsurance@jlt.ie

TIPS: The Motor line is the busiest. Bear in mind, when working remotely we do not have a call pickup function (i.e. we can only answer one call on each line at a time). Use email where possible for all Home/Motor/Travel queries, its much quicker : click here to email us: esbstaffinsurance@jlt.ie

RENEWALS

Home & Motor

Home & Motor renewals are renewed automatically. We will not cancel your policy due to non payment unless we have written/spoken to you directly.

If you pay by salary deduction, deductions for home and motor will stop a month priory to expiry and start up again the month after renewal eg. A March renewal, the last deduction will be February and the first instalment of the renewal will be taken in April (for weekly/fortnightly/monthly paid staff)

Travel Insurance is not automatically renewed

Travel policies are no longer being renewed with AGA. We have a new travel provider, Chubb insurance. For more information or if you wish to purchase a policy please click the following link to access our website at www.esbstaffinsurancescheme.ie

Working from Home

- There are provisions to work from home for business or professional purposes related to ESB or its subsidiaries. Under the current COVID-19 crisis Allianz have extended this cover to non-ESB employees permanently residing in your home

- Duties are restricted to Clerical/Admin activities

- This policy does not extend to cover third party liability i.e. you are not covered to hold meetings with anyone (whether ESBemployees or otherwise) in your home.

- This policy also provides cover for Business equipment (owned by you), limited to a total of €4000 with a single article limit of €1500

- Shomera: If any policyholder has a Shomera, this must be notified to us to ensure cover is extended. In addition, the building sum insured must be adequate to include same.

All of the above is subject to terms/conditions/restrictions/exclusions.

This is a broad outline of the cover provided by ESB Staff Insurance Scheme Home policy. We strongly recommend that you read the full wording which can be found on our website: www.esbstaffinsurancescheme.ie

UPDATE 27th. January 2020

The letter below appeared in the Irish Times on 23rd January, While it refers specifically to the case of RTÉ pensioners it is significant for the fact that the government is blocking an increase for pensioners of a semi state body.

Dear Sir,